Hello,

The bidding war over NHS landlord Assura took a few more twists this week. After KKR made its ‘best and final’ offer of £1.7bn, PHP hit back with a revised bid.

The FT also reported that some of Assura’s largest shareholders favoured PHP due to concerns that KKR’s bid would ‘lead to the company being taken off London’s stock exchange at a low price.’

And in other news:

- NatWest has ruled out bidding for TSB

- Unilever is exploring the sale of its Graze snack brand

- JPMorgan thinks UK banks are set for more consolidation

Thanks for reading, and connect with me on LinkedIn if you want to discuss how I can help with your next M&A deal.

Dealmaker spotlight

This week we spoke with Charles Lamport-Beale of Prism Corporate Broking, who went from studying Philosophy to navigating P&L in corporate finance.

He explained how his background shapes his approach to M&A and why more humanities grads should be considering careers in the industry.

Read the article to find out more, and get in touch if you’d like to be profiled in our newsletter.

Deal Tracker

Our weekly roundup of confirmed M&A deals in the UK.

Industry news

- UK inflation was 3.4% in May

- Bank of England keeps interest rates at 4.25% but hints at cuts to come

- Citigroup’s top UK bankers see sharp dealmaking rebound after tariff hit

The rumour mill

- Adriatic Metals accepts £930m offer from Canada’s Dundee

- Renold backs £187 million takeover offer from MPE

- Ontario Teachers’ to sell stakes in three UK airports to Macquarie

- FTSE 250 trusts Fidelity European and Henderson European set to merge

- Private equity takeover of De La Rue gets final clearance

- Sports Direct owner Frasers rules out Revolution Beauty takeover offer

- Oryx Global confirms no intention to make offer for Kenmare, as its shares fall

- Spectris continues Advent talks after rejecting rival KKR approach

- Metro Bank receives bid interest from Pollen Street

- KKR gets European Commission clearance for Assura takeover offer

- Assura weighs PHP’s revised offer terms as bid battle rumbles on

- KKR-led bid for NHS landlord hit by shareholder opposition

- Sabadell explores sale of UK high street bank TSB

- NatWest rules out bidding for TSB

- Hansa, Ocean Wilsons agree on merger to form £900m investment group

- Atlas Metals shares double as agrees potential reverse takeover

- Weir buys US engineering product maker Townley for £111m

- Unilever explores sale of healthy snack brand Graze

- CPPGroup sells off divisions to slim down to ‘insurtech’ arm Blink

- ME Group exploring strategic options including seeking possible bids

- Partners Group to buy UK’s MPM Products from 3i

- Advent exits Ultra PCS in £1.2bn sale to Eaton

- Sovereign exits Shackleton to Lee Equity Partners

- Livingbridge agrees to sell cybersecurity biz to Bregal Milestone portco

- UK banks are set for more consolidation, JPMorgan analyst says

- Stifel eyes European expansion after Bryan Garnier deal

- Pearson is to acquire career and technical education leader eDynamic Learning

Salaries and bonuses

- Peel Hunt bosses lose out on bonuses for third year straight

- Jane Street’s UK pay? £808k per head, £14m if you’re a partner

Job moves

- GAM names new CEO

- UBS hires BNP Paribas dealmaker Spens to bolster Nordic team

- JPMorgan’s European boss Gori set to move from London to New York

- Barclays hired the CTO of JPMorgan’s much admired UK retail bank

- JPMorgan’s Baygual exits

- HSBC’s Spring resurfaces

- JPMorgan picks LatAm exec to lead UK private banking after Gregson exit

- Ex-HSBC wealth boss Spring to head up Allfunds

- Morgan Stanley set to shift some London compliance roles to Glasgow

- Ex-Millennium portfolio manager joins crypto hedge fund Fasanara Digital

Market trends

Busier summer ahead?

Trump’s trade war threats continue to weigh on global M&A activity as corporate boardrooms delay major deals amid policy uncertainty, while simultaneously boosting trading revenues for Wall Street banks.

According to LSEG data, transaction counts have dropped 22% despite announced values rising 21%, with banks reporting significant pressure on advisory fees. Bank of America expects its investment banking revenue to be down 25% in the quarter from last year, while trading desks will likely benefit from increased market volatility.

Nevertheless M&A activity in 2025 has already outperformed the 2023 and 2024 digits, reaching approx $1.8 trillion YTD through June. Though still below the record $3 trillion peak achieved in 2021, recent weeks have seen a flurry of acquisitions and strongly performing IPOs.

Goldman executives are preparing for a busier summer period, however they caution this outlook depends on avoiding “more exogenous shocks, or more disruptive policy, which is maybe a big if.”

Fintech winter?

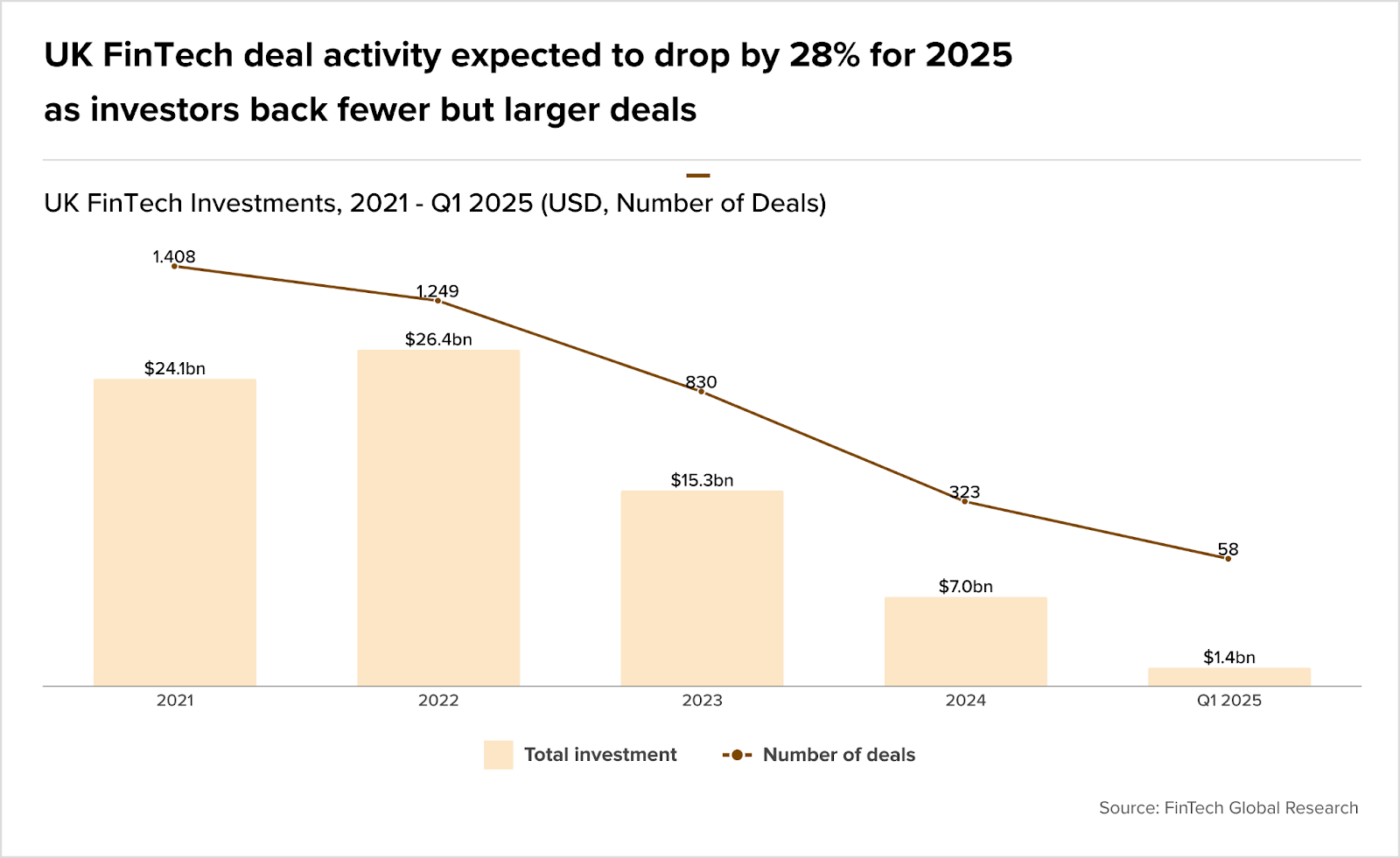

The cautious investor sentiment evident in broader M&A markets is manifesting even more dramatically in the UK’s fintech scene. Deal activity plummeted 52% in Q1 to just 58 transactions compared to 121 in the same period in 2024.

Furthermore, FinTech Global reported a 30% decline in funding, dropping to $1.4bn from $2bn in Q1 last year. Despite that, the average deal size has increased to $24.6m from $16.7m, indicating investors are backing fewer but significantly larger bets.

Projections suggest fintech deal activity will drop 28% for full year 2025, with standout transactions like nsave’s $18m Series A led by TQ Ventures and backed by Sequoia Capital highlighting how quality investments with proven business models continue to attract substantial capital commitments despite the overall market contractions.

Foreign buyers in $10 billion scramble for UK targets

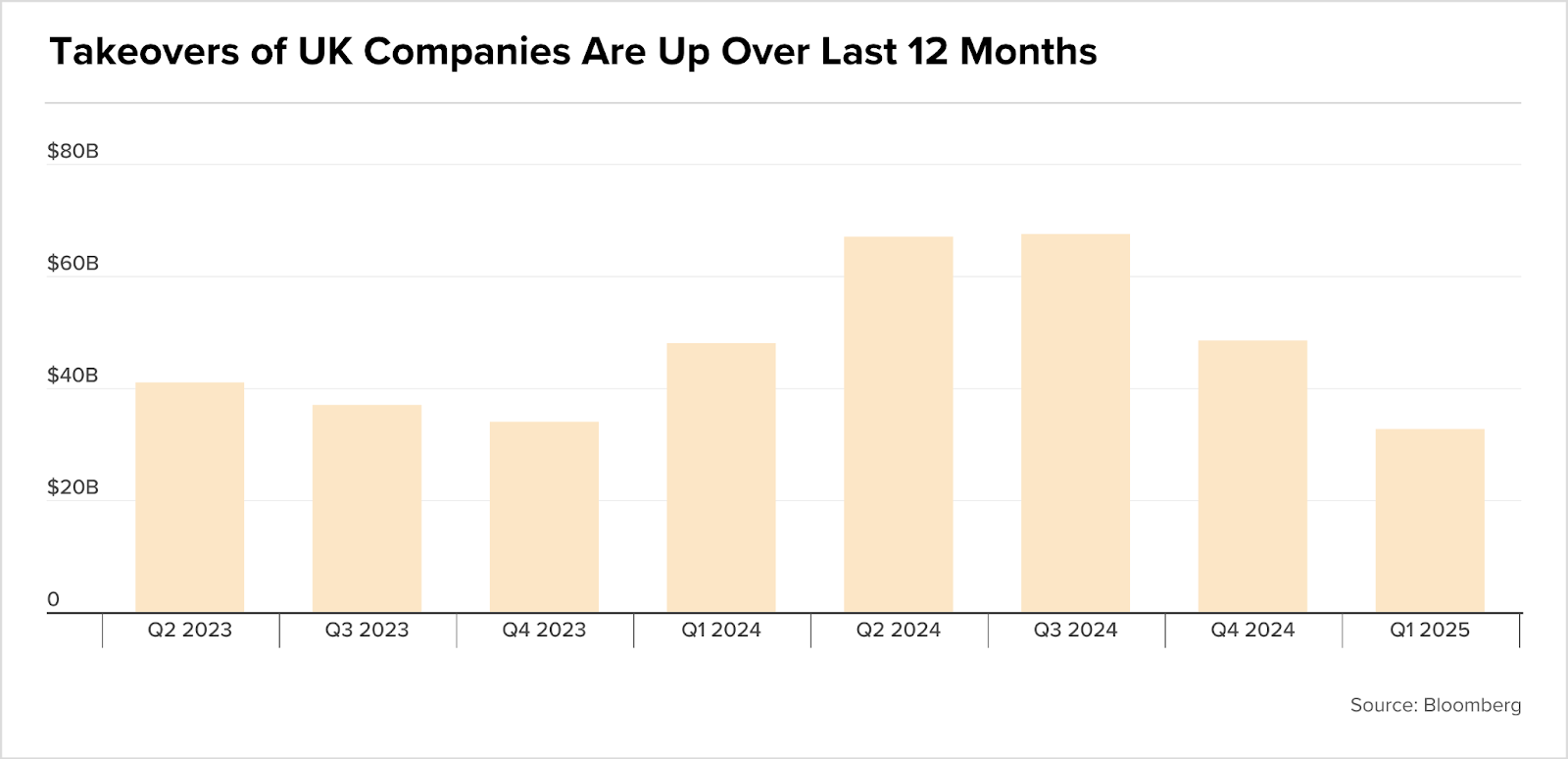

As I discussed last week, foreign buyers are capitalizing on discounted UK valuations in a rapid buying spree. Bloomberg reported on the fact that nearly $10bn of deals were announced in a single day, including Advent’s £3.7bn takeover of Spectris and Qualcomm $2.4bn acquisition of Alphawave IP, both carrying premiums above 80%.

The value of foreign takeovers has climbed 10% to over $140bn in the past 12 months, representing more than two-thirds of all UK deals, as buyers exploit the valuation gap between London’s FTSE 100 trading at 13.5 times earnings versus the S&P 500’s 22.9 times.

European firms fund their own M&A ambitions

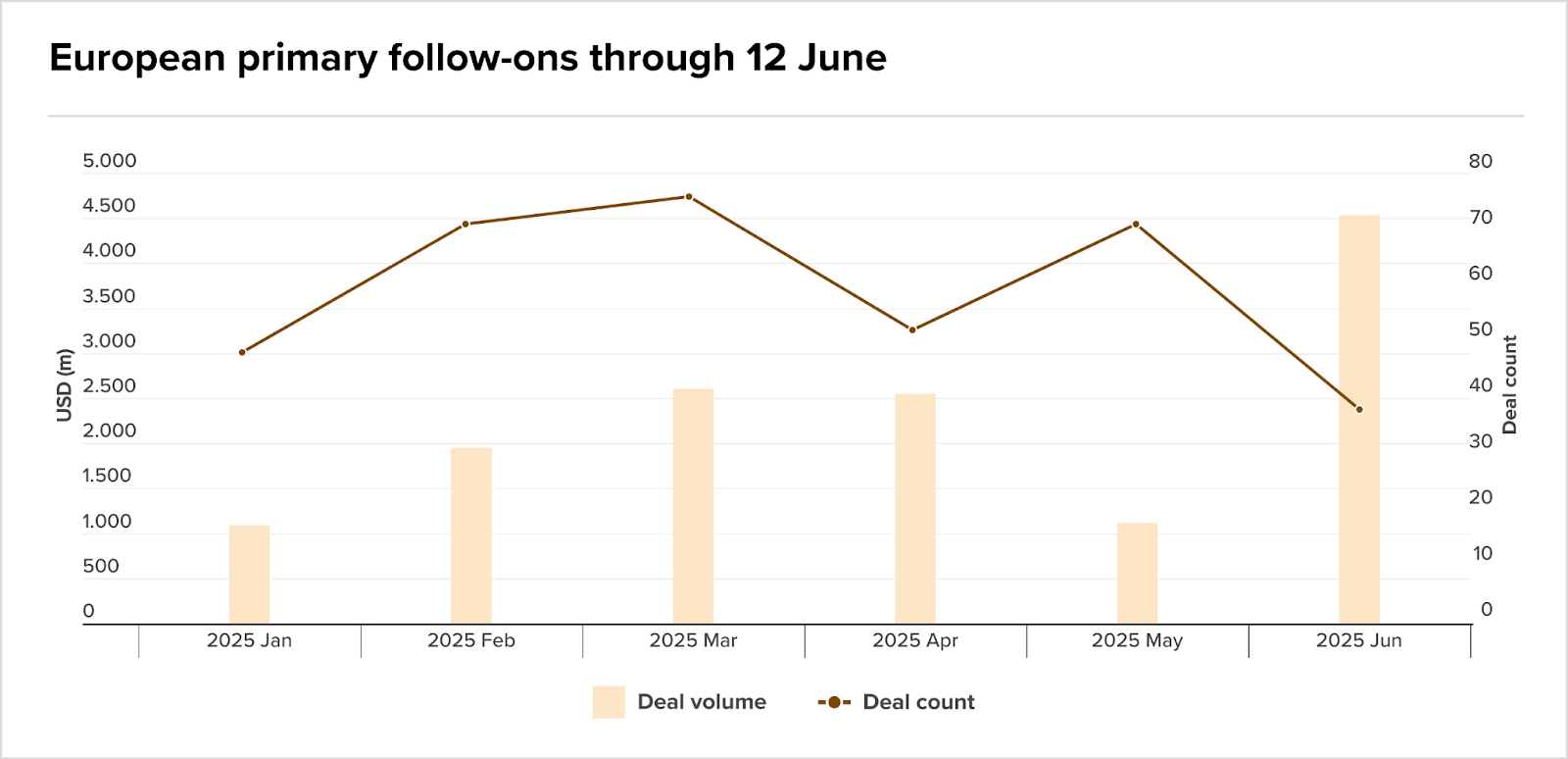

Following the surge in foreign acquisitions, European corporates are responding by securing equity financing to fund their own M&A ambitions, with their primary follow-on issuance reaching $4.5bn in June alone, marking the highest monthly value this year.

Notable transactions include Italgas’s €1bn rights issue to finance its 2i Rete Gas acquisition and Rosebank Industries’ £1.2bn raise for the $1.9bn ECI deal.

However, the window for such financing may be narrowing as geopolitical tensions between Israel and Iran create market choppiness, while Trump’s negotiations with China and concerns over rising US debt costs threaten to shut equity markets again after the July 9 tariff pause expires.

IPOs

- Peel Hunt loss widens as UK firm boosts IPO work with Santander

- London seeks more Chinese listings as City battles IPO drought

Daniel Black

Daniel Black