Even a single outdated spreadsheet or an accidental leak can derail a deal. That’s why today’s top dealmakers turn to secure virtual data room solutions.

This end-to-end platform is a command center for due diligence, a collaboration hub for teams, and a safeguard for sensitive information. These cloud-based services allow buyers, sellers, and other interested parties to review and exchange documents quickly and confidently from anywhere.

Key takeaways

- Virtual data rooms for mergers and acquisitions centralize documents and protect sensitive information throughout the deal lifecycle.

- VDRs speed up due diligence with structured folders, fast search, version control, and built-in Q&A.

- Strong security measures such as encryption, granular permissions, MFA, and audit logs ensure confidentiality and compliance.

- A clear data room setup keeps the platform organized and buyer-ready.

- AI tools such as redaction, smart search, and summaries reduce manual work and accelerate decision-making.

What is an M&A data room?

An M&A data room, also referred to as a virtual data room (VDR), is a secure digital platform used to store, manage, and share confidential documents during a merger or acquisition. The solution provides users with an intuitive user interface, controlled access to information, and collaboration tools.

While traditional physical data rooms require on-site visits and in-person document handling, virtual solutions provide a secure online repository where interested parties can access documents anytime without compromising confidentiality.

A VDR solves the following core problems in the transaction process:

- Secure document sharing prevents data breaches.

- An organized due diligence process ensures that documents are stored in a standardized format.

- Access control and oversight ensure teams see only the information relevant to their role and stage of the deal.

- Streamlined workflows reduce administrative burden through advanced VDR features.

- Faster deal cycles help buyers assess risks more efficiently and accelerate decision-making.

A virtual data room for M&A is a security requirement and an efficiency engine. The platform enables teams to run due diligence with speed, transparency, and compliance.

Additional resources: Stay informed about current M&A cybersecurity.

When do you need a data room in M&A?

Below, we examine how VDRs work across the mergers and acquisitions lifecycle.

1. Early-stage buyer interest (teasers, NDAs, preliminary discussions)

Process

Buyers receive high-level financials, market data, and product info to determine whether the deal is worth exploring. At this point, sellers avoid exposing sensitive information.

M&A data room application

Virtual data rooms provide a secure space to share introductory materials with all potential buyers simultaneously and track who engages with what.

2. Indication of interest or management presentations

Process

Buyers refine their valuation assumptions and require more operational details, such as revenue breakdowns, customer metrics, and basic legal documents.

M&A data room application

The solution organizes expanding document sets, avoids emailing files to multiple bidders, and guarantees everyone sees the same information.

3. Confirmatory due diligence

Process

This is the most profound and rigorous stage. Review teams examine financial statements, tax records, major contracts, HR data, compliance documents, IP, and operational KPIs.

M&A data room application

A deal room centralizes all documents, enforces strict permissions, supports fast navigation with indexing/search, and manages Q&A at scale.

4. Financing, investor presentations, and syndication

Process

Banks, PE sponsors, and co-investors analyze the deal’s risk profile, cash flow stability, and collateral. Thus, they need validated numbers and reliable documentation.

M&A data room application

The platform enables secure, role-based access for external financing parties and ensures they receive clean document versions.

5. Regulatory review

Process

Regulators may require proof of antitrust compliance, licensing, data protection practices, and industry-specific approvals.

M&A data room application

The software allows controlled access for regulators with full audit logs, ensuring transparency while protecting non-relevant confidential information.

6. Post-merger integration

Process

After signing, integration teams must understand systems, contracts, processes, HR policies, and financial workflows to merge operations efficiently.

M&A data room application

The platform delivers as a structured repository of all vetted diligence materials, supporting smooth knowledge transfer during integration.

Additional resources: Discover the power of M&A integration tools to streamline and organize your entire deal process.

Must-have virtual data room features that speed up M&A due diligence

Mergers and acquisitions due diligence can involve thousands of documents, multiple stakeholders, and tight deadlines. Virtual data room services address common pain points and accelerate review by providing the following features.

Additional resources: Unlock smarter deals with artificial intelligence for M&A due diligence.

Next, we explore how M&A data rooms protect sensitive data and ensure compliance throughout the transaction process.

VDRs in M&A: Essential data security and compliance features

Most virtual data rooms combine advanced security measures, regulatory compliance, and operational resilience to ensure confidential information remains secure throughout the deal lifecycle.

1. Data residency and physical security

Where your data is stored and how it is physically protected are fundamental to compliance and confidentiality. These measures ensure sensitive documents remain secure from unauthorized access.

2. Encryption and access control

Protecting data in transit and controlling who sees what is critical in M&A deals. Encryption and precise permission settings prevent leaks and allow authorized stakeholders to review documents safely.

3. Document protection and management

Managing sensitive information extends beyond data storage. Therefore, virtual data room providers offer redaction, revocable access, and watermarks to safeguard content even after documents are shared.

4. Operational resilience

Data availability is as important as confidential data protection. Redundant infrastructure, real-time backups, and disaster recovery protocols ensure uninterrupted document access for worldwide teams.

5. Compliance

Meeting regulatory standards and industry best practices builds trust and avoids legal pitfalls. Compliance ensures your data room aligns with global requirements throughout the transaction lifecycle.

Key standards include the following:

A reliable M&A data room provider offers multi-layered protection that goes beyond standard file-sharing solutions. By combining encryption, granular access controls, redaction, watermarking, and operational resilience, they ensure sensitive documents remain secure, compliant, and accessible only to authorized users.

Additional resources: Discover the best M&A data rooms providers to find the solution that suits you best.

Typical structure of an M&A data room

A clear, standardized folder structure helps deal teams navigate documents quickly, maintain data room security, and streamline the due diligence process.

High-level folder structure example

This high-level structure groups core documents into clear categories, making due diligence easier to navigate.

- Corporate documents

- Financial information

- Contracts and agreements

- Intellectual property

- Employee and HR information

- Operations and technology

- Litigation and regulatory

- Environmental, health, and safety

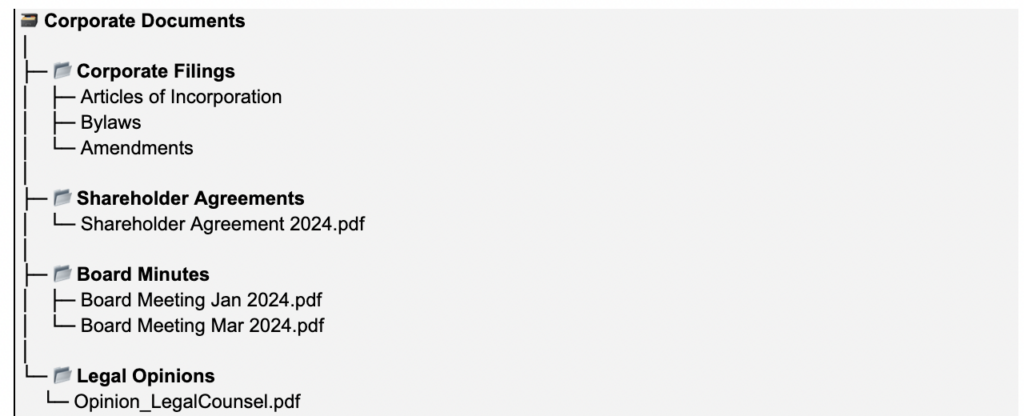

How a high-level folder breaks down

Here is the hierarchical example from the main folder to the subfolders:

Organizing, naming, and setting access permissions for subfolders

A well-structured M&A data room ensures documents are easy to find, reduces errors, and keeps sensitive information secure. Following the practices below helps streamline due diligence and keeps the deal on track.

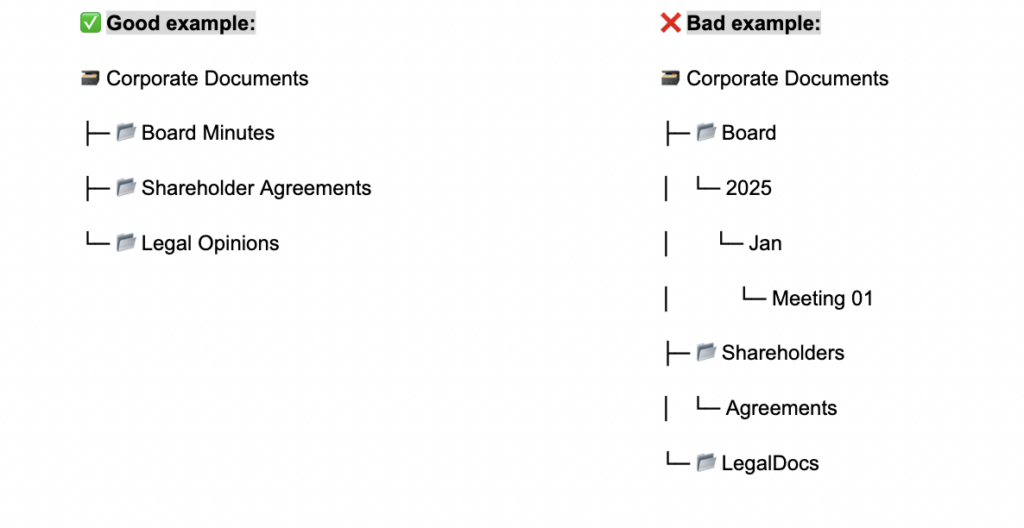

1. Subfolder organization

- Group related documents together for intuitive navigation.

- Maintain a simple hierarchical structure when possible.

- Avoid over-nesting subfolders.

- Use consistent folder structures across main categories.

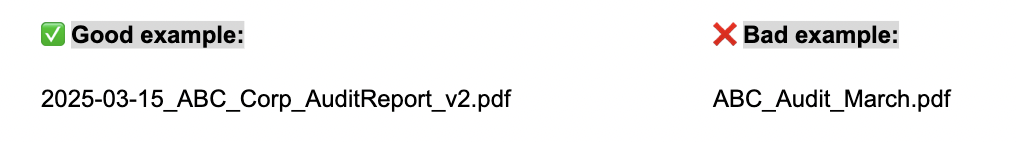

2. Naming conventions

- Include dates, company name, and document type.

- Use short and descriptive names.

- Incorporate universally understood abbreviations.

- Include version numbers for frequently updated documents.

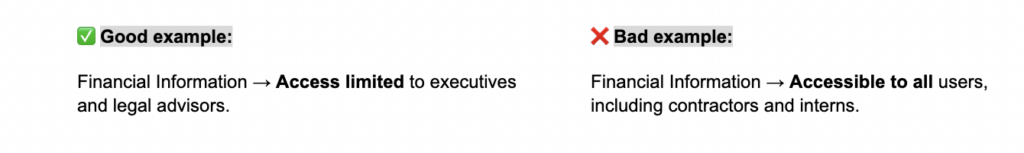

3. Access control

- Allow authorized users to access only relevant documents.

- Restrict sensitive folders (financials, HR, IP) to a limited group.

- Remove permissions for inactive participants.

- Track document activity through audit logs.

Must-have documents for an M&A data room

Below is a checklist of essential documents buyers expect during due diligence. These materials help validate financial performance, assess risks, and confirm the overall health of the business.

1. Corporate and legal

- Articles of incorporation/Certificate of formation

- Bylaws or operating agreement

- Shareholder/partnership agreements

- Board and shareholder meeting minutes

- Corporate structure chart

- Business licenses and permits

- Certificates of good standing

2. Financial Information

- Audited financial statements (3–5 years)

- Unaudited interim statements

- General ledger and trial balance

- Revenue breakdowns (product, customer, region)

- Cash flow statements

- Financial projections and assumptions

- Tax returns (federal, state, local)

- Debt schedules and loan agreements

3. Contracts and agreements

- Customer contracts (top clients highlighted)

- Supplier and vendor agreements

- Distribution and reseller agreements

- Lease agreements (real estate and equipment)

- Licensing agreements

- Joint venture or partnership contracts

- Insurance policies

4. Intellectual property

- Patent registrations and applications

- Trademark registrations

- Copyrights

- Domain names

- IP assignments and licensing documentation

- Confidentiality and invention-assignment agreements

5. Human resources

- Employee roster with roles and compensation

- Employment agreements

- Benefits plans

- Independent contractor agreements

- Organizational chart

- HR policies and handbooks

- Records of disputes or claims

6. Operations and technology

- Description of core operational processes

- IT systems architecture

- Software inventories and licenses

- Data protection policies

- Product roadmap and R&D documentation

- Supply chain documentation and vendor lists

7. Litigation and regulatory

- Pending or past litigation summaries

- Regulatory filings and correspondence

- Compliance reports

- Government inspections or audits

- Environmental assessments (if applicable)

8. Environmental, health, and safety

- Environmental permits

- Safety certifications

- Incident reports

- Waste management documentation

- EHS policies and audits

Before you start: Important notes about this document checklist

The following clarifications help ensure you assemble a complete, accurate, and secure package for buyers.

Key points to keep in mind:

- Document requirements differ by deal type, jurisdiction, and industry. Some complex financial transactions, especially regulated or cross-border deals, may require additional materials.

- The checklist is most relevant for share deals. In asset deals, certain corporate governance documents may not apply.

- Environmental, health, and safety materials are industry-dependent. They are only required for businesses with environmental exposure or regulatory obligations.

- Files should be provided in a buyer-ready format. Teams should use searchable PDFs, merge related documents, avoid duplicates, and follow naming conventions.

These considerations help you prepare a complete and secure online space, which is easy for buyers to review.

Step-by-step guide for setting up an M&A data room

Follow the steps below to set up your platform properly.

1. Define the data room scope and objectives

Before uploading files, determine what to include in the data room and who will access it.

- Identify the type of transaction (full sale, minority investment, merger, etc.).

- Decide what information will be shared at each stage (teaser, early-stage diligence, confirmatory diligence).

- Establish confidentiality rules for internal contributors.

2. Assign team roles and responsibilities

Define who is responsible for each part of the M&A virtual data room before uploading documents. Start by mapping ownership of key categories (finance, legal, operations) and decide who can upload, review, and approve final versions. Keep editing permissions limited to essential team members to maintain accuracy and control.

3. Set up the folder structure

Create a logical, buyer-friendly layout based on your company and deal specifics.

- Use a standard high-level structure.

- Build subfolders that mirror your internal documentation workflows.

- Keep the structure easy to navigate.

4. Configure permissions and access controls

Control access based on user roles and the sensitivity of each folder in your data room for M&A.

- Grant role-based or group-based access.

- Restrict sensitive areas (HR, litigation, financials).

- Enable fence view or limited viewing modes when needed.

- Regularly review access and remove inactive users.

5. Upload and organize documents

Populate the data room efficiently and accurately.

- Use bulk uploads and cloud integrations to save time.

- Apply labels/tags and consistent naming conventions.

- Use a due diligence checklist for completeness.

- Maintain version control to avoid outdated files.

6. Review and publish content

Always verify documents before making them visible to buyers.

- Check for missing pages, outdated versions, and inconsistent naming.

- Use redaction tools for personal or confidential information.

- Publish only after legal and financial advisors’ approval.

7. Set up Q&A workflows

Enable structured communication between the buyers and sellers.

- Activate the Q&A module with clear categories.

- Assign internal experts to answer specific question types.

- Keep all discussions linked to relevant documents.

8. Monitor activity and maintain the data room

A well-managed data room requires ongoing oversight.

- Track user engagement and document activity.

- Respond to Q&A promptly.

- Update documents as new information becomes available.

- Use audit logs to monitor compliance and access history.

9. Prepare for closing

Finalize the M&A virtual data room as the transaction nears completion.

- Provide final agreements, disclosures, and closing documents.

- Ensure all required electronic signatures are collected.

- Archive the data room for regulatory and post-deal needs.

Proper setup lays the foundation for a smooth, efficient due diligence process and helps the transaction stay on track.

Typical pitfalls in M&A data room management

Even the best virtual data rooms only work if used correctly. Address common challenges with proper setup and management.

- Disorganized folders → Keep hierarchy shallow, use consistent structures, and label files clearly.

- Incomplete or outdated documents → Use a due diligence checklist and maintain version control.

- Unclear access permissions → Assign role-based access and regularly review user permissions.

- Q&A management confusion → Centralize all questions and link them to relevant documents.

- Low visibility on activity → Track engagement with analytics and audit logs.

A properly configured M&A data room is secure and efficient. Any “pitfalls” arise from how teams set up and manage the platform.