Hello,

Here’s what’s new in Indian M&A this week.

Fantasy sports platform Dream Sports is stepping up its game with a $50 million infusion into Cricbuzz and Willow TV, as the group pushes into digital sports media.

New-York based Bat VC, co-founded by the former head of X India, is chasing breakthroughs with a $100 million AI-focused fund.

In telecoms, Singaporean conglomerate, Singtel, quietly exited 1.2% of Bharti Airtel for $1.54 billion, one of the largest block trades this year.

And finally, rumour has it that industrial heavyweight Sajjan Jindal’s family trust is putting ₹1,200 crore of JSW Infrastructure on the block to meet new minimum public shareholding rules.

I hope you enjoy this week’s roundup, and please do connect with me on LinkedIn to find out how I can help with your next M&A deal.

Deal Tracker

Our weekly roundup of all the confirmed M&A deals in India.

Market Trends

Regulator lures quality capital to make land a more liquid asset

Indians have a near-neurotic love for owning land for legacy and permanence. Take pioneering angel investor, the late Rakesh Jhunjhunwala, who famously bought up luxury apartments in South Mumbai’s Malabar Hills, only to tear them down to construct a 14-storey family abode.

Among the priciest real estate in the world, the neighbourhood boasts ex-residents like Jinnah and Jardine (the father of the nation of Pakistan and the cricketer who captained England during the Bodyline tour) and current resident, Radhakishan Damani, industrialist, who spent more than ₹1,001 crore ($122 million) buying a 90-year old bungalow there in 2021.

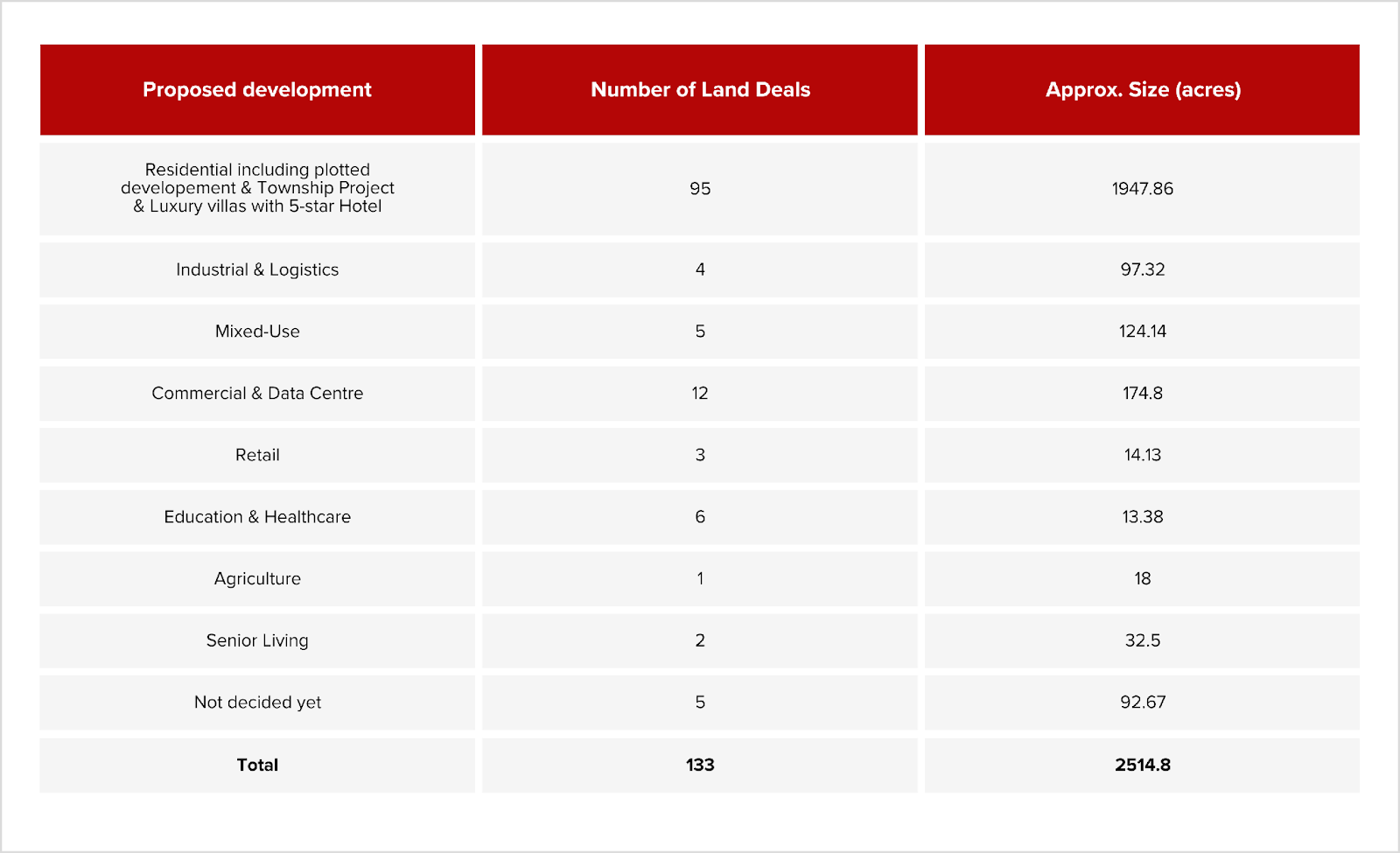

However, Delhi NCR outperformed Mumbai last year, achieving the largest number of land deals of all the Indian Metropolitan cities. Overall 95 out of 133 major transactions — i.e. either deals of scale over 10 acres or with a consideration north of ₹100 crore — were residential projects, nearly 1,950 acres, dwarfing industrial, mixed-use and healthcare developments combined.

Courtesy: Business Standard

This comes as regulators have helped reframe land from a sentimental heirloom to a liquid asset, and mindsets from scarcity to abundance, especially as REITs and InVits (Infrastructure Investment Trusts) gain popularity.

American alternative investment manager Blackstone led the charge: it paid $2.84 billion in 2014 for real estate developer Embassy’s logistics and office parks, and another $890 million for property developer Prestige Group’s Bengaluru office portfolio in 2018.

Making land more tradeable

In March, SEBI relaxed lock-in rules for real estate and infrastructure trusts to boost long-term institutional inflows and deepen private capital participation. The changes will also facilitate follow-on public offers, and are part of a broader strategy to align real estate more closely with private capital markets. While no REIT or InvIT has yet taken advantage of the new rules, the regulatory shift signals intent: the government wants land assets to be more tradeable.

This is especially important as institutional interest in India’s built environment grows. American commercial real estate services and investment firm CBRE’s data shows transaction activity in the first nine months of 2024 was led by logistics (39%), engineering & manufacturing (19%) and retail (11%) — all sectors that depend heavily on land and infrastructure.

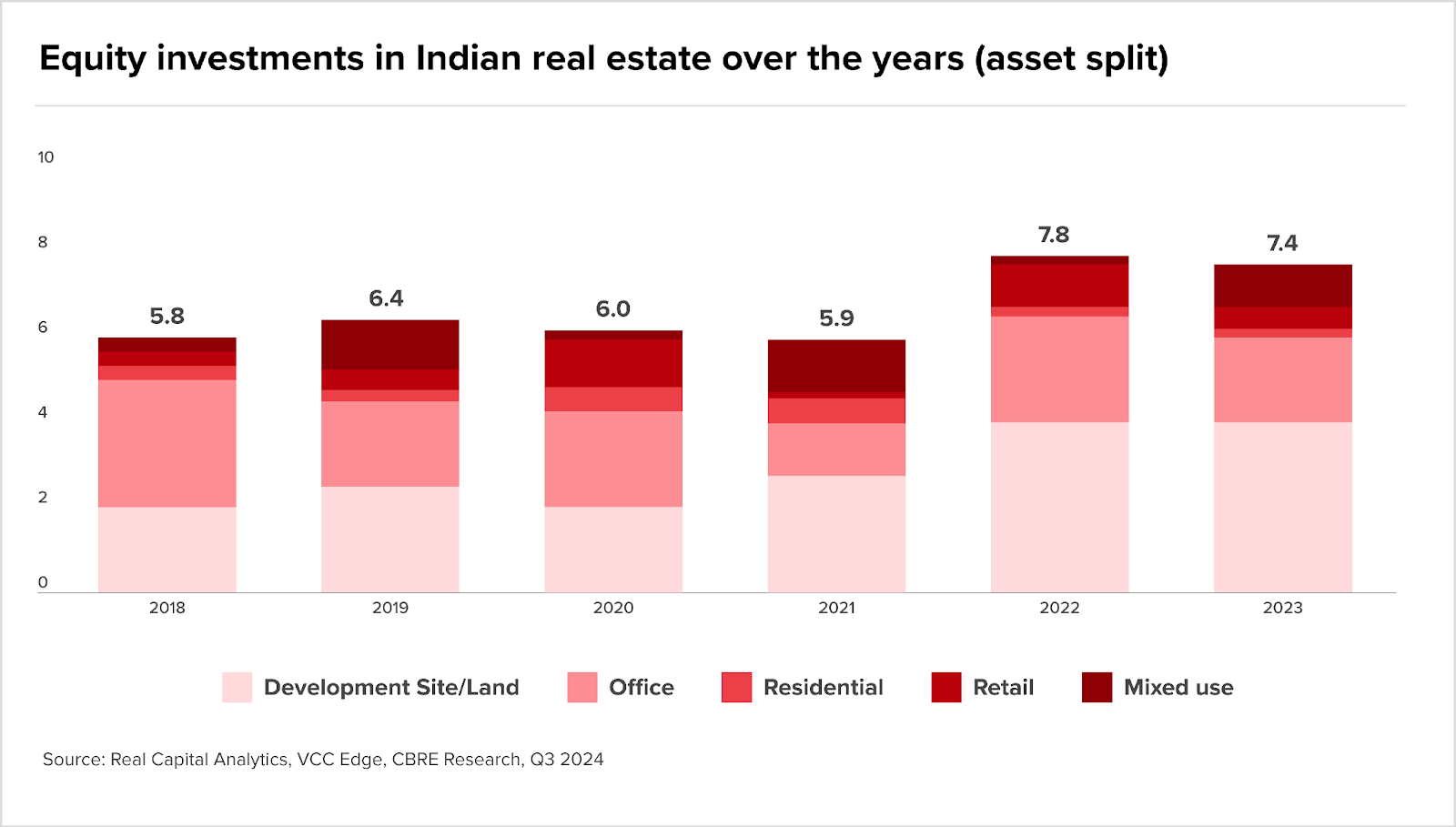

Meanwhile, equity investments in Indian real estate climbed from $5.9 billion in 2021 to $7.8 billion in 2022, before settling at $7.4 billion in 2023. Most of this was in development sites and land.

Recognising real estate’s multiplier effect, policymakers are keen to attract high quality and long term capital, stabilising the sector and spurring growth in the wider economy. The belief is that stable funding can drive growth in healthcare, education, transport, and scientific research — all of which require land and infrastructure.

A risky investment?

And yet, this optimism exists alongside risk. A December 2024 EY survey of fund managers ranked real estate as the riskiest sector for defaults. The reasons are structural: delays in approvals, regulatory inconsistencies across the different Indian states, etc.

M&A will play a key role in this next phase. Large funds will stitch together land parcels and package stressed assets into portfolios. All parties from crossover and strategic investors, including global funds, to domestic corporates and tech-aligned capital will increasingly back turnkey, or move-in ready, developments.

Soon real estate in India will be less about legacy and more about liquidity.

The rumour mill

- Renault Group seeks CCI nod to buy out remaining 51 % stake in Indian JV

- Cyprus Business Now: India business ties, BoC general meeting, TechIsland Summit

- JSW Paints set to add lustre with Akzo India buy

- How did Motilal Oswal Alts’ second fund fare in exit as it backs NBFC from new vehicle?

- SEBI approves merger of Sumuka Agro Industries Limited with Gujjubhai Foods

- “LIC FPO Soon, IDBI Stake Sale On Track”

- Surana Solar board approves 49% equity divestment in Surana Technologies

- Dream Sports to invest $50 Mn in Cricbuzz and Willow TV

- BW LPG Terminates $10 M Investment in India

- ITT sets ambitious 2030 financial targets, eyes M&A growth

- CCI approves acquisition of majority stake in Nazara by Axana Estates, Plutus Wealth, and Junomoneta Finsol

- Ceigall India board approves merger of Ceigall Infra with C&C Construction

- India Is Hot Trade Again as Funds Chase Trump-Era Winners

- India approves Foxconn-HCL semiconductor JV setup

- Why Funding India’s Green Startups is Crucial for an Equitable, Low-Carbon Energy Transition

- Bajaj Group gets CCI’s clearance to acquire Allianz’s stakes in insurance joint ventures for Rs 24,180 Cr

- India’s Greenko founders eye new deal to buy stake from Orix

- Lumax Auto to acquire remaining 25 % stake in IAC India for Rs 221 Cr

- Reliance Power to build Bhutan’s largest solar project in ₹2,000 Cr JV

- Slew of PSU stake sales soon; govt plans to divest 6.5 % in LIC in tranches

- OFS today: Wendt India shares set to bleed as parent eyes 37.5 % stake sale at 38 % discount

- Wendt India OFS: Stock plunges 20 % as offer for sale kicks off for non-retail investors

- New rules of wealth: Where smart money is headed for the next 5 years – expert breaks it down

- Trump says he doesn’t want Apple building products in India: ‘I had a little problem with Tim Cook’

- Singtel’s Pastel to sell 0.8 % stake in Bharti Airtel in block deal

- CCI clears AIPCF’s 13 % stake buy in Perseus parent

- Apple supplier Foxconn to invest $1.5 B in India unit

- Cabinet approves ₹3,706 Cr HCL-Foxconn semiconductor JV in Uttar Pradesh’s Jewar, to create 2,000 jobs

- Tamasek-backed Shiprocket eyes IPO; Blackstone places bid for Statkraft

- India’s IREDA files second bankruptcy case against Gensol’s EV leasing unit

- Premji leads $45 M funding in Lambda Test

- ReNew Energy Global to invest $2.57 B in solar, wind project in India

- Fewer larger cheques: India’s seed-stage investors opt for conviction over volume

- Vivriti Asset Management is tapping into the $342 B MSME credit gap

- After stock split, Hyderabad-based AI company mulls acquisition, fundraise via FCCBs; FIIs own 22 % stake

- Omnicom-IPG merger under global scrutiny – US, UK & India regulators yet to share approval

- Rama Prasad Goenka considers CEAT-Tyres, KEC bids and Bombay Dyeing takeover in RPG group shake-up

- Bharti Airtel share price slumps nearly 3 % amid reports of stake sale by Singtel worth ₹8,500 Cr via block deal

- Norwest leads ₹1,465 Cr investment in IKF Finance to boost growth

- KPR Mill promoters to sell up to 3.2 % stake via block deals to raise Rs 1,196 Cr: CNBC-TV18

- SEBI may delay Hinduja’s Invesco acquisition amid IndusInd Bank fiasco

- Rs 40,000 crore for defence forces to procure arms, ammunition approved, says report

- India’s space sector set to soar

- IDBI Bank Acquisition Hopes Prompt Emirates NBD To Go Down The WOS Route — Profit Exclusive

- CCI Okays Temasek Holdings Minority Stake Purchase in Haldiram Snacks Food

- Global Funds Reignite Interest in India Amid Trade War Tailwinds

- Yes Bank Expects SMBC to Maintain 20 % Stake Amid Strategic Investment Deal

- India’s private capex growth remained robust over FY21-FY25E, reported a 19.8% CAGR: Report

- Abraaj spin-off RMBV likely to onboard another European LP

- Indian regulator approves new nuclear site

M&A news

- Identity at the Core: Powering Secure M&A in India’s Digital Surge

- Singtel sells 1.2% stake in Bharti Airtel via private placement for Rs 13,180 crore

- Funding and acquisitions in Indian startup this week [May 12 – May 17]

- JSW’s Rs 1,210 Cr Stake Sale Fuels Ambitious AkzoNobel India Acquisition

- Logicap deepens strategic partnership with Mitsubishi Estate through follow-on investment in India’s industrial and logistics infrastructure

- Mark Mobius: U.S.-India Trade Deal Is ‘Very Significant’ for Investor Confidence

- Indian Institute of Petroleum and Energy joins hands with Magnivia Ventures to set up energy research park

- Apple’s China shift begins with Foxconn’s $433 M chip deal in India

- Why AIFs are the future: Aashish Somaiyaa explains the big shift | Navigate with HSBC

- Neo Group Invests $20 M in Nobel Hygiene

- Private credit no longer a Plan B for India Inc

- India Deal Review: $899 M start-up funding hits 14-month low in April

- Singtel sells 1.2% stake in India’s Bharti Airtel for $1.54 billion

- Indian startups raise $194 million this week

Fundraising

- SBI shares in focus after board approves $3 B fundraising plan

- Franklin Templeton India Mutual Fund announces merger of its two international funds, to change name of surviving scheme

- Former 100X.VC partners launch early-stage fund, target raising Rs 250 Cr corpus

- 247VC launches Rs 200 Cr fund

- CureBay Raises $21 M To Expand Rural eClinics Across India

- Hygiene product maker Nobel Hygiene raises ₹170 crore from Neo Asset Management ahead of IPO

- Premium ice cream maker Hocco raises $10 M in Series B round

- Ice cream brand Hocco raises $10 M in Series B; eyes Rs 450 Cr revenue, national expansion

- Healthtech startup Complement 1 raises $16 M in round led by Owl Ventures, Blume Ventures

- Kriscore Capital Announces First Close of INR 100 Cr Debut Fund

- New York-based Bat VC, co-founded by former X India head, announces $100 million AI-focused fund

- 247VC Launches INR 250 Cr India Fund I to Back Bold Founders at Seed Stage

- Kotak Mahindra AMC’s Kotak Credit Opportunities Fund Announces First Close with over INR 1,200 crore raise

- Deeptech startup Biostate AI raises $12 M led by Accel, others

- Hocco, 1-India Family Mart, Medvital in funding news

- IndiaRF targets $1 B for second fund, IFC mulls $40 M commitment

- Newly launched Indian VC Kriscore Capital secures first close of $11.7 M debut fund

- Miraggio, Tan90 Thermal, PaySprint raise funding

- Hocco Secures $10 M in Series B Round

- Naptapgo raises ₹2 Cr in Pre-Seed funding to redefine affordable hospitality

- K Balakrishnan’s Kriscore Capital raises Rs 50 Cr in commitments for new micro VC fund

- SBI fundraising: India’s largest PSB approves raising long-term funds up to $3 B in FY26; Check details

- VC firm 247VC launches $30 M fund for Indian tech startups

- Bain-Piramal’s India resurgence fund targets $1 B in second outing, taps returning LP

- Global real assets investor Patrizia raising new Asia fund with likely India mandate

- Value retailer 1-India Family Mart pockets Series D funding

- Used car retailing startup Spinny raises $13.2 M in Series A co-led by Accel & SAIF

- Kriscore Capital’s maiden fund announces first close of Rs 50 Cr

IPOs

- India’s IPO door opening for fast-track ‘reverse flips’

- Zomato and Temasek-backed Shiprocket pre-files DRHP with SEBI for IPO

- Belrise Industries to Launch Rs 2,150 Cr IPO on May 21

- Schloss Bangalore sets IPO price band at Rs 413-435

- Schloss, owner of India’s Leela Hotels, slashes IPO size by 30 % to $409 M

- Indian healthcare AI startup Qure.ai targets profitability next fiscal, aims for IPO in two years

Compliance/regulatory update

- Insolvency Globalization: India’s Adoption Of TheUNCITRAL Model Law

- Sajjan Jindal Family Trust plans ₹1,200 Cr stake sale in JSW Infra to meet MPS norms

- India likely to drive global growth, benign home inflation strengthens RBI’s rate cut hopes

- Reserve Bank of India to discuss liquidity management with lenders

- India central bank to discuss liquidity management with lenders

- RBI proposes new norms for RE investments in AIFs, seeks public feedback

- RBI to meet banks to review liquidity management framework

- Bhushan Power & Steel judgment: A judicial earthquake in India’s insolvency landscape

Harsh Batra

Harsh Batra