Hello,

PE continues to dominate India’s deal landscape even as M&A cools elsewhere. Partners Group is set to acquire 75% of Infinity Fincorp in a $230 million transaction, marking a decisive move into Indian financial services. In infra, a $750 million Apollo-led investment in Adani’s Mumbai airport signals deepening global interest in regulated assets.

Meanwhile, Adani Power’s $480 million bid for Vidarbha Industries Power received NCLT approval, another win for India’s bankruptcy code.

On the consumer side, Diageo has taken a majority stake in Nao Spirits, backing India’s homegrown gin wave. Nuvoco’s $216 million acquisition of Vadraj Cement is a promising bit of industrial M&A.

In big-ticket brewing, Reliance and Havells are reportedly eyeing Whirlpool’s global business, heating up the chase for a marquee global business that may lead up to a very competitive bid or JV. There are rumours at SBI General Insurance of Warburg Pincus’s exit, which may bring in new strategic interest, or even a listing.

I hope you enjoy this week’s roundup, and please do connect with me on LinkedIn to find out how I can help with your next M&A deal.

Let’s dive in.

Deal Tracker

Our weekly roundup of confirmed M&A deals in India.

Market Trends

Collateral beauty

Civilizations across the ages have lusted after gold, prizing it as a symbol of wealth and power. So who can argue when Bain Capital considers paying up for an 18% stake in Kerala-based lender Manappuram Finance as a means to enter India’s approximately $86 billion+ gold loan market?

That and the recent acquisition of Paul Merchants Finance’s gold loan business by L&T Finance suggest rising compliance costs, fintech ambitions, and private equity timelines are converging, as the sector enters a phase of consolidation, thanks to gold’s countercyclical appeal and deep rural reach.

At the same time, the RBI’s 2024 draft norms are pointing to a crackdown on scale inefficiency and informal practices, especially around loan-to-value (LTV) tracking, gold purity standards, and tenure ‘enforcement’ – the period during which a borrower must repay the loan.

Smaller NBFCs and cooperatives, long reliant on looser practices, may find it unviable to meet tighter compliance standards, pushing them toward strategic sales.

The golden hedge

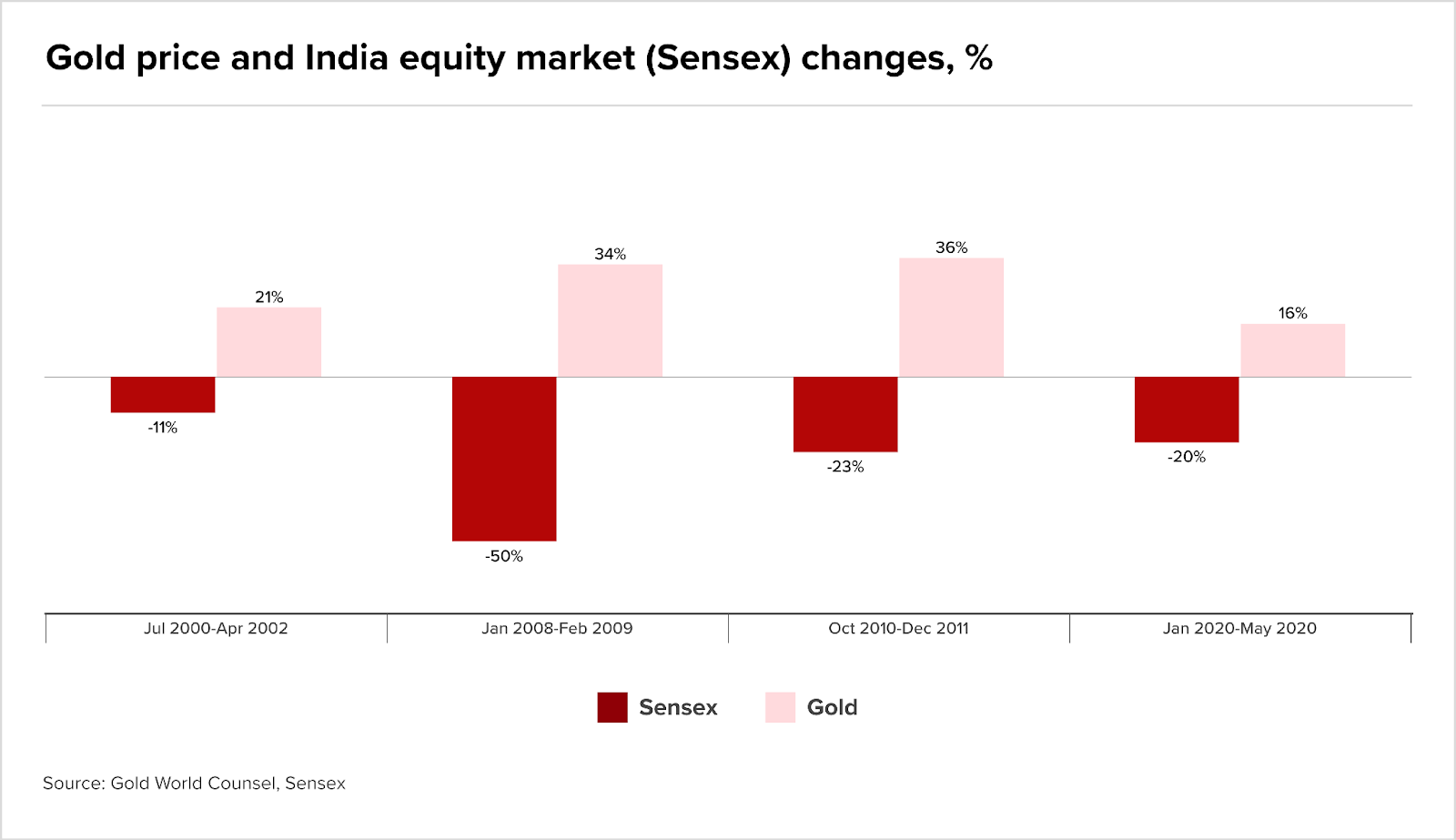

Historically, whenever Indian equities have faltered, gold has surged. During the 2008 crash, Indian markets plunged by 50%, while gold rose 34%. In the Covid-linked dip of early 2020, gold again outperformed equities. This pattern makes gold a great hedge for investors and a critical lifeline for lenders.

In India, demand for gold is as cultural as it is economic. Jewellery ownership often doubles as collateral, keeping the households’ credit engine running in hard times. With domestic gold prices relatively stable, NBFCs and banks have long relied on gold lending to anchor their secured portfolios.

As of May 2025, the gold price in India has delivered over 25% year-to-date returns.

Source: World Gold Council

For lenders, this translates into strong recovery value on defaults and a predictable, inflation-resistant asset, especially useful in rural regions where land titling is murky and enforcement is costly.

Book designs

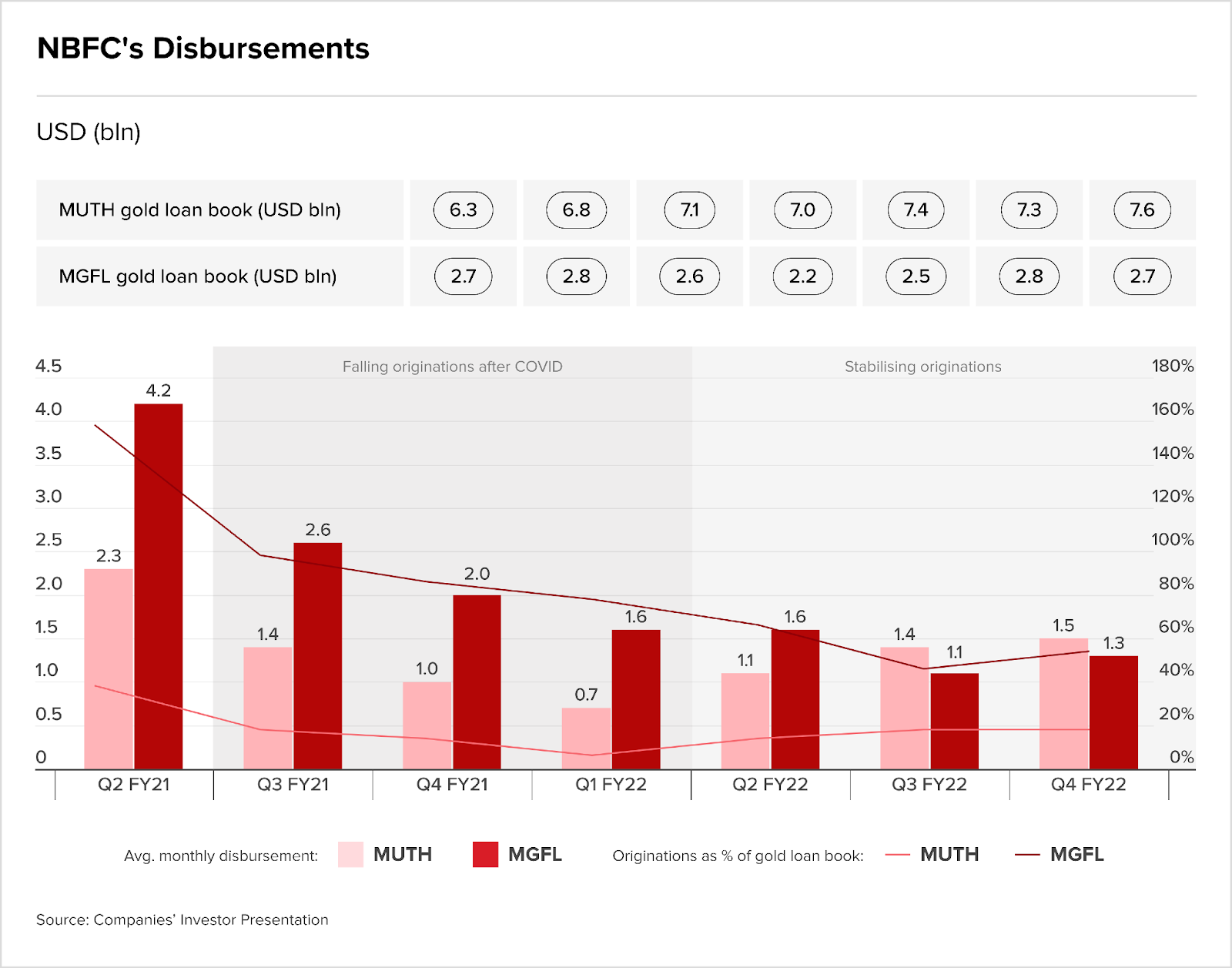

FY21-FY22 data shows how gold loan disbursements fell from their Covid highs but have since stabilised. Kerala-based leaders Muthoot Finance (Muth) and Manappuram Finance (MFGL) – the lead players in the sector – have maintained steady gold loan books in the range of $6.8-7.6 billion and $2.6-2.8 billion, respectively.

Source: VEF

This stabilisation reflects a shift from emergency borrowing to more structured demand, pointing to long-term viability. Monthly disbursements as a share of loan books have returned to pre-Covid levels, indicating improved portfolio management.

For buyers like L&T, this signals an opportunity to acquire seasoned portfolios and ready branch infrastructure with manageable risk.

A formal expanding, an informal shrinking

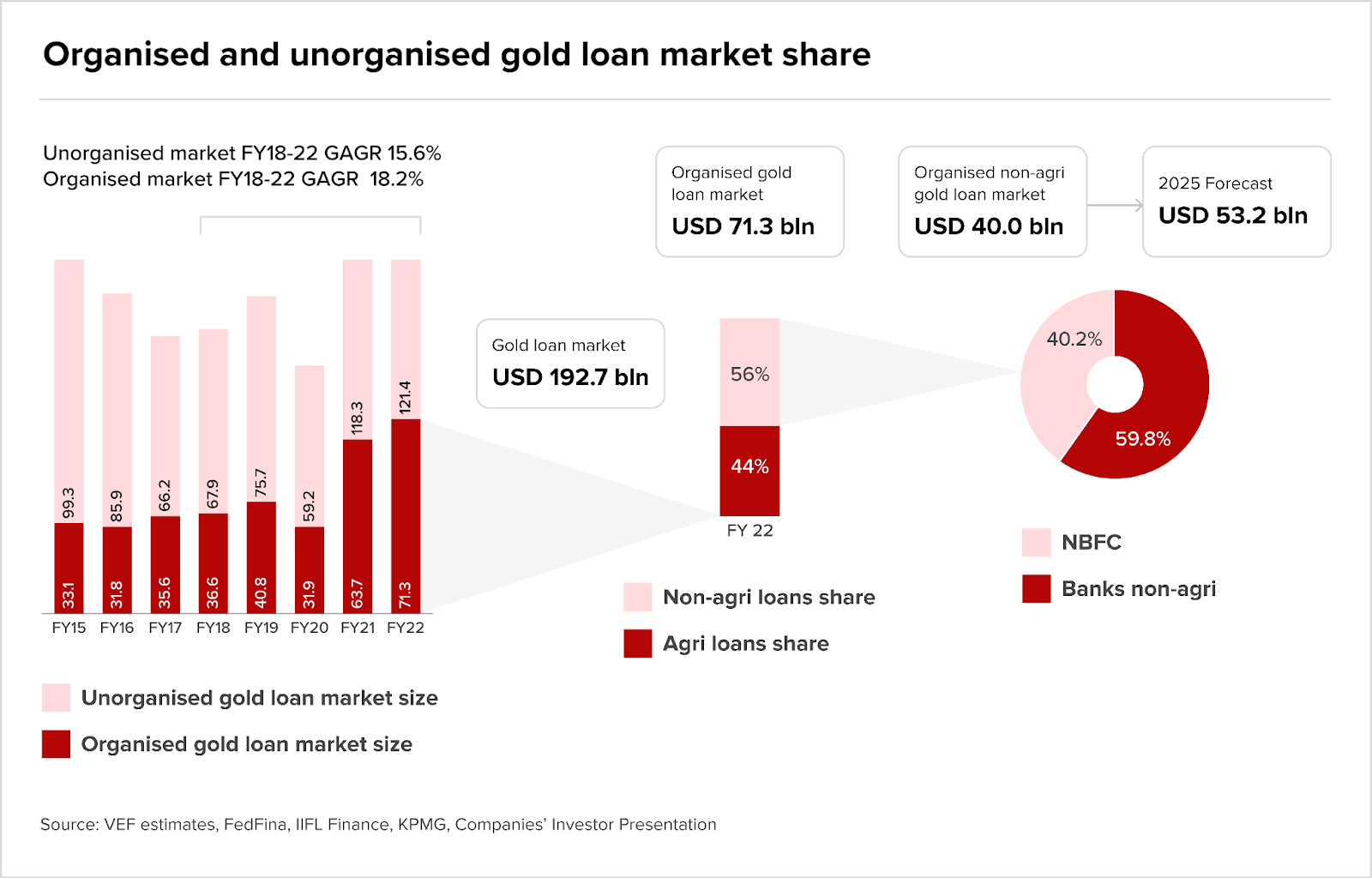

Between FY18 and FY22, India’s organised gold loan sector, comprising banks and NBFCs, grew at a compound annual rate of 18.2%, outpacing the unorganised segment. In FY22, the organised market accounted for $71.3 bn, or 37% of the total $192.7 billion gold loan market.

Forecasts suggest the organised non-agri gold loan segment alone will hit $53.2bn by 2025. Within the organised share, NBFCs control 60% of the market, with banks accounting for the remainder.

This structure makes smaller NBFCs perfect M&A targets for private banks looking to deepen rural credit quickly; and also larger NBFCs, seeking to expand compliance-ready books, who see gold lending as a natural next step after maturing unsecured credit businesses.

Let us not forget India’s fintech firms, such as Rupeek – they see gold as the fastest way to break into secured lending.

Meanwhile, big private equity players like Warburg Pincus (invested in Muthoot) or Bain Capital (formerly in Axis Finance) may be looking to consolidate or exit as the sector matures.

Looking at the big picture, India’s gold loan businesses will have to formalise fast because of policy reform, driven by resilient asset performance and stable disbursements. The macro story (gold’s resilience), the micro story (NBFC balance sheet health), and RBI tightening are nudging toward a consolidation wave.

Deals like L&T’s acquisition of Paul Merchants could be an early sign of a sector entering its M&A moment.

The rumour mill

- $230mn deal: Partners Group to acquire 75% of Infinity Fincorp

- Byju’s RP’s suit claims directors owe compensation to company under IBC laws

- DayOne seeks fresh $1bn loan to fund growth plans – report

- Decision on merger with Biocon Biologics soon, says Siddharth Mittal

- Gentari plans to offload up to 50% stake in India arm

- Global PE firms bet on small, nimble Indian tech ventures

- India, China Companies Explore Technical Tie-Ups as Government Plans Electronics Manufacturing Push

- Japan’s MOL Plans Strategic Investment in Indian Logistics

- JPMorgan expects Indian firms to step up selective overseas acquisitions

- MakeMyTrip plans $3 billion buyback; China’s Trip.com stake to drop below 20%

- Novo holdings eyes expansion in India, Indonesia

- Oiling the wheels: PE funds buy into fast-growing tech firms

- PE firms pursue Asian loans to fund investor payouts

- RBI Unlocks Flexibility For Foreign Owned And Controlled Indian Entities

- Reliance & Havells enter PE party to snap up Whirlpool

- Rs 2,434 crore ‘fraud’: CBI opposes Jai Corp, Anand Jain’s pleas against FIR

- SoftBank explores buyout deals in India to accelerate AI-led IT services, BPO play

- Sukino Healthcare Solutions in talks with investors for fresh capital

- Tata Consumer’s ‘antennas up’ for strategic buyouts

- Waaree Energies gets board nod to acquire Kamath Transformers for Rs 293 crore

- ICICI sought to acquire HDFC, reveals chairman Deepak Parekh

- Karuturi Ceramics up for sale on 7th July; reserve price fixed at Rs 21.15 crore

M&A news

- Adani’s Mumbai airport inks $750m deal with Apollo-led investor group

- Aspora raises $93m from Sequoia, others to scale cross-border banking for global Indians

- Block deals: Private equity firm TPG Asia VII SF PTE offloads 10% stake in Sai Life Sciences

- FDI to India slid 1.8% in 2024, reflecting declining share in capital formation: UN report

- Global trading giants step-up India presence

- Herbert Smith Freehills Kramer advises Wipro Enterprises on its proposed acquisition of a majority stake in French Lauak Group

- IBC Sees Highest-ever Recovery in FY24-25 but Resolution Delays and Haircuts Remain a Drag: ICRA

- Incuspaze acquires Pune-based TRIOS in 100% buy-out deal, targets ₹400 cr revenue in FY26

- India’s K-beauty boom: How D2C growth and seed-stage bets propelled it to No. 3 globally

- India’s new gold loan rules to reshape lenders’ business models, says S&P

- Insolvency plea filed against FirstCry subsidiary GlobalBees

- Japan’s Enrission backs Pico Xpress and other India deals

- Jio Financial Acquires 17.8% Stake Of SBI In Jio Payments Bank For ₹105 Crore

- Loop Industries secures $1.5M for its India JV

- Manappuram Finance acquisition: Bain Capital gets CCI nod! Investment firm to acquire 18% stake

- NCLT approves Rs 4,000-cr bid by Adani Power for Vidarbha Industries Power

- Private equity sits on $1 trillion amid uncertainties, M&A stalls, PwC says

- Private-Public Deal Momentum Grows, Yet Megamergers Stay Elusive

- Reliance Infra’s arm partners with Dassault aviation to manufacture Falcon 2000 in India; first delivery expected in 2028

- S&P raises India’s FY26 GDP growth estimates to 6.5%

- The mix of adjectives and data reveals the real story in tech IPO documents

- Vanguard Group buys 1.1% stake in Vishal Mega Mart for Rs 655 crore

- VCs love start-ups—But why are they turning away from MSMEs?

- Vedanta offloads 1.6% stake in Hindustan Zinc to raise ₹3,028 crore

- Why India’s Budding EV Sector Has Opened Its Doors To China

- Why Strategic Disinvestment Is Fiscal Necessity, Not Just Opportunity

- Zerodha’s Nikhil and Nithin Kamath acquire Rs 250 crore stake in InCred Holdings

Job moves

- Blackstone’s ASK plans to hire 70 wealth bankers in India

- Co-founder Moksha Bhat takes reins at AP & Partners

- Fresh exits at Krutrim as company ramps up work on AI models and semicon chips

- Union Bank Of India ED Pankaj Dwivedi Removed, Demoted As GM At Punjab & Sind Bank

- Zou Jiayi: New AIIB President

IPOs

- JSA Is Advising Bharat Coking Coal On Its Proposed IPO

- Walmart’s Phonepe looks to raise $1.5bn from India IPO

- Findi Appoints DAM Capital and Ambit to Lead TSI’s Indian IPO

- Capillary Technologies files IPO papers; aims to raise Rs 430 crore via fresh issue

- India’s HDB Financial IPO pricing not influenced by 70% premium in grey market, bankers say

- IPO-bound BlueStone geared for unicorn tag

- Prosus delays Indian payments firm Payu IPO

- Reverse flipping by Indian startups gathers steam: Here’s all you need to know

Compliance/regulatory update

- An explainer on market changes from SEBI’s recent board meeting

- Defence Ministry kicks off overhaul of acquisition procedure as big-ticket, indigenous military buys take centerstage

- Indian limited partners can now co-invest directly in private market deals, regulator says

- New Amendments To Resolution Process Regulations In India

- RBI Gold Loan Rules: BIG impact on lenders and business model? S&P finds key insights – DETAILS

- RBI opted for outsized rate cut to boost growth, minutes show

- Sebi opens co-investment window for LPs makes it easier for PEVC funds to exit via IPOs

- Sebi slaps Rs 29 lakh fine on IAGF, trustee for AIF rules violation

- SEBI’s new co-investment rules for AIFs: Who benefits and how

- Vishal Mega Mart promoters selling stake makes it an MSCI inclusion candidate — Explained

Harsh Batra

Harsh Batra