Hello,

This August, Indian M&A rose to $15.9bn driven by record M&A volumes and two landmark cross-border transactions.

KKR made a few headlines when finance chief Lewin predicted PE firm consolidation. Meanwhile, KKR and Blackstone have chosen to turn India into Asia’s buyout HQ as investors look beyond China, a shift which may indicate more competition for targets and higher valuations.

Further, Vedanta ‘beat’ the Adani Group with a ₹17,000 crore ($2.04 billion) bid to acquire JAL. The deal will see Vedanta pay ₹4,000 crore ($480 million) upfront and the rest over the next six years.

Worth mentioning is that edtech was having a day – interest was invited for resolution of Byju’s insolvency case, while PhysicsWallah filed to raise $437m from an India IPO.

And finally, Urban Company was sold within hours of listing and Amazon completed BNPL lender Axio’s acquisition.

I hope you enjoy this week’s roundup — please connect on LinkedIn to discuss your next M&A deal.

Let’s dive in.

Share your thoughts on AI for a chance to win $100

Please complete this short survey and you’ll be entered into a prize draw to win one of three $100 Amazon vouchers.

How are you currently using AI during M&A deals? We’re surveying top dealmakers on how they use AI as part of a major research project.

Deal Tracker

Our weekly roundup of confirmed M&A deals in India.

Market Trends

White elephant much?

Aphorisms such as ‘the data centre is the computer,’ reportedly spoken by Chase Lochmiller of US-based cloud provider, Crusoe; or ‘I don’t know any company, industry or country who thinks that intelligence is optional, it’s essential infrastructure,’ from Nvidia’s CEO Jensen Huang – may for now explain why capital is sprinting into data centre (DC) markets globally.

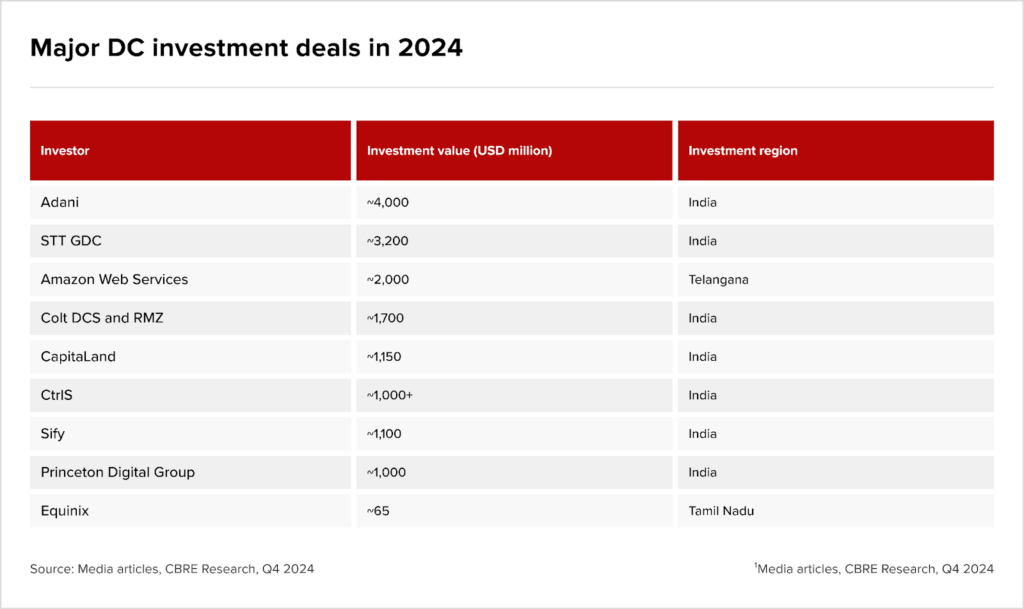

In India, a flurry of trophy transactions in 2024 and lease demand heavily skewed toward hyperscalers have made the market irresistible to sponsors and strategics.

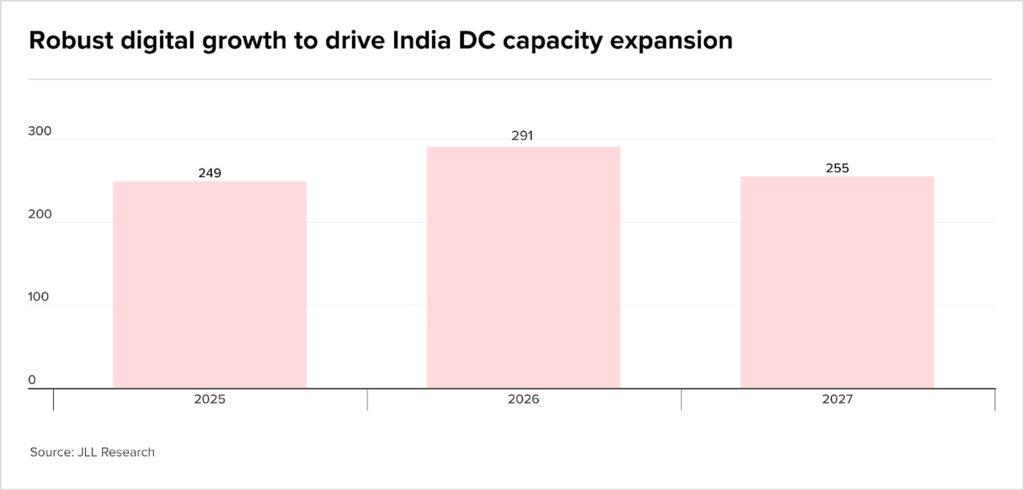

JLL projected industry capacity to jump toward 1.8 GW by 2027, while Colliers pegged India’s potential at 4.5 GW by 2030 with $20bn or more in fresh investment.

But the same forces that justify aggressive growth also seed fragility. Are investors chasing it? Could the DC frenzy produce stranded white elephant assets?

Monolithic bets

India’s deal list reads like a who’s-who of infrastructure and hyperscale capital: multi-hundred-million and -billion investments by Adani, STT GDC, AWS, CapitaLand, CtrlS, Sify, Princeton Digital and others have validated valuations and attracted follow-on capital.

Reports show India crossed the 1 GW milestone in 2024 and is adding roughly a quarter gigawatt per year in the immediate horizon, with multi-GW plans to 2030.

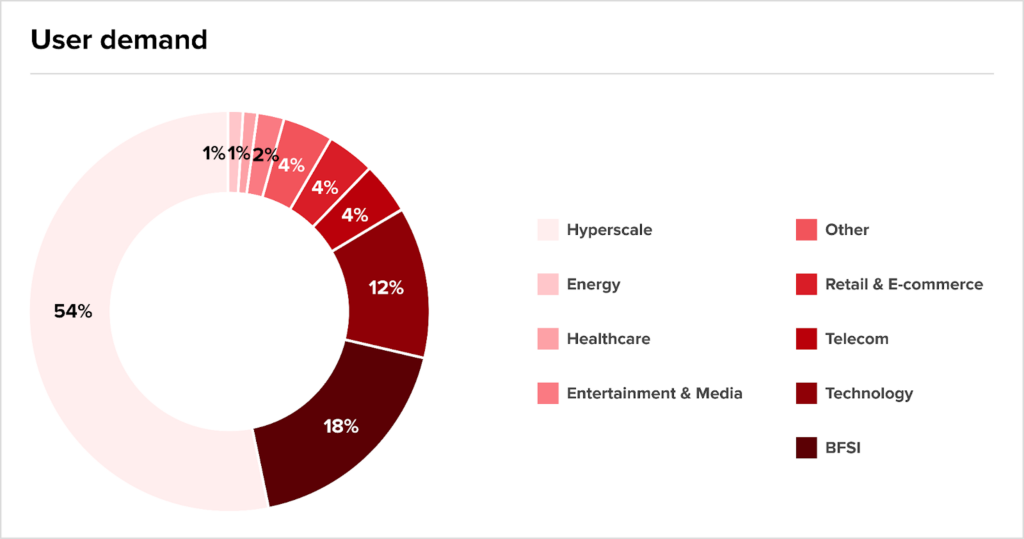

Demand is concentrated and for now predictable, and leasing is dominated by a small number of high-volume occupiers. Hyperscalers account for the lion’s share of leasing, followed by BFSI and large tech firms, meaning deals with hyperscaler pre-lets or strategic partnerships can command premium pricing and lower revenue risk.

But that concentration is a two-edged sword: if hyperscalers pause or change strategy, the pipeline will shrink fast.

Bull market or bubble?

There are many reasons to have a positive view of the current market. Rent cash flows can behave like long-dated infrastructure attractive to pensions and infra funds, and strategic owners (hyperscalers, telcos, large corporates) want regional capacity to deploy cloud and AI.

Meanwhile, PE will see classic roll-up plays across smaller operators and development pipelines.

However, there are also clear fault lines. Concentration risk is real: Mumbai alone accounted for nearly half India’s pipeline, so a single snag with land, power or interconnection can delay hundreds of MW.

And power supply is not trivial: data centres are energy-hungry, and underestimated grid upgrades or slow renewables deals can quickly erode the project economics that underpin expected IRRs.

The AI story that justifies many builds also holds substitution risk. Model architectures, hosting patterns and silicon choices are evolving fast, and a move toward compact on-prem or edge LLMs, or hyperscalers keeping more inference on custom silicon in their own campuses, could shave material portions of projected colocation demand.

Finally, financing and exit assumptions matter: higher rates or weaker buyer appetite at stabilisation would compress returns and leave developers exposed.

What next for dealmakers?

For M&A teams there are a range of defensive options: insist on take-or-pay terms, lock long-dated power or credible brown-to-green pathways, structure phased capex with option value and seller earn-outs, and stress-test models assuming 20-50% of hyperscaler leasing is delayed or replaced by smaller-model deployments. That approach separates resilient assets from potential white elephants.

India’s DC market is a rare infrastructure-plus-tech opportunity: large, investible and strategically vital. Its upside is a concentrated hyperscaler pipeline and strong policy tailwinds; the downside is concentrated execution and a plausible tech pivot that could leave parts of the pipeline redundant.

For M&A teams the best strategy isn’t to ignore the build, but it’s to structure deals that buy optionality, secure demand and de-risk power and regulatory execution. Get those three right and you win; miss them and you could be left chained to a white elephant.

The rumour mill

- ResponsAbility’s Asia Climate strategy closes in on target with IFC commitment

- Nothing eyes Rs1000 crore JV, plans India as global export hub

- Global MNCs are looking for JVs in India’s semiconductor sector

- Axis AMC looks to add offshore investors to LP base

- Opening Stargate to India: ChatGPT parent talks tieup with local firms, also in talks with Reliance

- Jio Financial Services executes joint venture agreement with Allianz.

- India Ad Group Explores Financing For Dentsu Deal

- Dassault Aviation buys 2% stake in JV with Anil Ambani’s Reliance, taking majority control

- Amber Group’s ILJIN Electronics Secures Rs 1,200 Crore in Private Equity Funding

- Indian impact investor Aavishkaar plans new deep tech equity fund

- US$900m Loan, Write-backs and Pledged Assets: Viceroy Alleges Vedanta Used ‘Creative Accounting’ To Fund US$2bn Dividend

- India’s Private Spacetech Boom: A New Era Unfolds

- SIS to widen security perimeter with Rs 650 crore APS Group buyout

- Indian, Chinese Firms Speed Up Joint Ventures After Modi-Xi Meet

- Varun Beverages shares in focus on JV incorporation with White Peak Refrigeration

- RVNL–Texmaco JV to take shape by November with ₹200-crore investment

- Torrent Pharma Announces Open Offer To Acquire Rs 6,843-Crore Stake In JB Chemicals

- Japan Mizuho financial group Avendus deal hits roadblock valuation

- OpenAI to Acquire Product-Testing Start-Up Statsig for $1.1Bn, Founder Named CTO of Applications

- Bank of Baroda classifies Anil Ambani and RCom as ‘fraud’, alleges fund diversion

- Morgan Stanley PE-backed Omega hospitals in talks to buy rivals

- 40 kg gold, diamonds from Nirav Modi’s Firestar International up for sale

- Sumitomo Mitsui To Likely Exit Kotak Mahindra Bank with Rs 6,000 crore Block Deal

- Tata Motors’ Strategic Move into European Commercial Vehicles via Iveco Acquisition

- Tata Motors markets $4.5 billion loan for Iveco acquisition

- Beer brand Medusa beverages in talks to tap new investor, revises revenue target

- ₹6,256 Cr Block Deal: Bank stock in focus after FII offloads 1.65% stake in the Company

- India’s infra investment trusts look to list amid push for wider investor base

- Jaiprakash Associates acquisition: Vedanta offers to pay ₹4,000 crore upfront, rest over 5-6 yrs — Report

M&A news

- KKR Finance Chief Lewin sees PE firm consolidation

- Explained: Why are Vedanta investors disappointed on Rs 17,000-crore Jaiprakash acquisition bid

- Dealmaking gathers pace in India

- Petrochemical push: ONGC partners with Japan’s Mitsui to build Dahej plant

- Indian businesses record M&A worth $11.4 billion in August, highest in value since June ’22: Report

- Indian private equity enjoys the spotlight

- HEG’s LNJ Bhilwara Group acquires Statkraft’s 49% stake in Malana Power Company

- NBFCs and private credit reshaping India’s finance ecosystem

- Global capital turns selective, India stays on the investment map: Hines’ Steinbach

- India Walks a Tightrope of Risk and Stability in Markets

- Strategic Foreign Divestments in Indian Banking: Assessing Sumitomo Mitsui’s Kotak Stake Sale

- Govt extends fast-track merger route to more sets of firms

- KKR Blackstone turn India into Asia’s buyout HQ after China dip

- KKR CFO predicts wave of private equity consolidation amid dealmaking slowdown

- GST revamp to set off demand, investment, job cycle: FM Nirmala Sitharaman

- From YouTube to Dalal Street: Inside PhysicsWallah’s public market play

- DGCA Grants Safety Clearance To Air India-SATS Joint Venture For Ground Handling Operations

- IDBI Bank disinvestment on track for FY26 completion: FM Sitharaman

- India’s VC Market Hits New Highs: Domestic Investors Drive 36% Share Of Private Capital AUM

- EoIs invited for resolution of Byju’s insolvency case; 24 Sept last date for submission of interest

- India’s export landscape in flux amid US tariffs, low demand

- S&P India sovereign rating upgrade due to constant engagement, says Finance Minister

- Boardroom Dynamics: Observer vs. Director In India’s Evolving PE/VC Landscape

- India’s Supreme Court quashes prospect of Ericsson SEP antitrust probe

- G-sec yield surge hurts long debt mutual funds opportunity in sight

- Barclays sees $100 billion plus AI M&A deal within a year

- Oil and gas giants ADES, Shelf Drilling seek merger clearance in India under Form II

- Multibillion dollar deals fuel pickup in India’s M&A activity

- Flats linked to Gitanjali Gems promoters set for auction in October

- Cyclical easing in SE Asia’s PE fundraising despite strong global flows

- Kuwait-headquartered EQUATE Group reaffirms commitment to strengthening partnership with India

- Goldman Sachs’ $10 Billion Hybrid Capital Fund: A Strategic Lifeline for Distressed Private Equity

- Phoenix group to sell Classic Vacations to India’s TBO for up to $125M

- Japan’s Softbank trims stake in India’s Ola Electric to 15.7%

- Ivycap Ventures leads funding in Flexifyme and other India deals

- India: Quick commerce startup Firstclub raises $23m led by Accel, RTP Global

- IDBI Bank in focus as divestment nears final phase; four bidders in the fray, says report

- CCI approves acquisition of Dana Incorporated’s off-highway business by Allison Transmission Holdings, Inc.

- The bar has risen for LP cheques when it comes to risk

- Hedge fund style strategies lure India’s rich as private market premiums shrink

- S&P Global Market Intelligence Speaks with Baker McKenzie’s Eric Schwartzman on the Increase in Large Leveraged Buyouts and What it Means for the Market

- Top execs from Everstone Capital, Foundation PE, Synergy Capital and Somerset Indus Capital speak on India’s private equity comeback

- SAM, Mori Hamada guide SAMIL’s bid for Honda Motor unit

Salaries and bonuses

Job moves

- Hidetaka Kokubu Appointed as Head of Japan at Xsolla

- Kalyan Kumar set to lead Union Bank as Lalit Tyagi may join Central Bank amid reshuffle

- India’s NSE names Srinivas Injeti new chairperson in a step towards bourse’s listing

- Marriott Appoints Kiran Andicot as Senior VP for South Asian Region

- Hogan Lovells adds Paul Hastings’ Beijing, Shanghai partners

- Org Chart: Inside BigBasket’s C-Suite shuffles and tweaks for a quick commerce era

- Punjab & Sind Bank Appoints Jitendra Asati as Director

- RBI approves Yes Bank board changes as SMBC prepares stake acquisition

IPOs

- Turtlemint files confidential papers with Sebi for IPO

- From LG Electronics to Urban Company: Can India’s IPO rush deliver sustainable returns?

- Edtech firm Physicswallah files to raise $437m from India IPO

- IPO ahead, Urban Company’s ‘all things home’ push meets growth-profitability test

- Urban Company raises Rs 854 crore from anchor investors ahead of IPO

- India: Urban Company IPO subscribed within hours of launch

Compliance/regulatory update

- WEEKAHEAD Indian rupee faces choppy path, bond yields likely to decline; inflation data key

- India’s RBI Cut US Debt, Bought Gold Even Before Trump’s Tariffs

- USD/INR ticks down on RBI’s likely intervention, weak US NFP data

- SEBIs Revises Framework for Conversion of Private Listed InvITs into Public InvITs

- GST Rate Overhaul: What it Means for Inflation, RBI Policy, and Fiscal Deficit

- Recent M&A Reforms in India: What Dealmakers Need to Know

- Raamdeo Agrawal advocates for bold reforms in India amid US tariff challenges

- New GST reforms slash healthcare costs, boost insurance access

- From exporters to bond traders, RBI is facing calls to step in

- SEBI Eases Delisting Norms for PSUs with Over 90% Govt Holding; Fixed Price Exit Allowed Above Floor Price

- The reform agenda: Why pushing strategic disinvestment will be crucial

- Sebi sets limits on LP co-investments to prevent indirect control of portfolio firms

Harsh Batra

Harsh Batra