Season’s greetings,

We’re fast approaching the end of the year, but not everyone is distracted with Christmas shopping and work parties. A few deals still managed to get over the line and there’s plenty of activity in the rumor mill.

Making my list this week are:

- Regulators announcing a probe into BlackRock’s £2.5 bn Preqin takeover

- A mooted sale of Jimmy Choo and Versace by Capri Holdings

- Barclays hiking bonuses by 20% for some bankers

We’re taking a break over the New Year, so will be back with the next Teaser UK on January 9. Here’s wishing you a relaxing and enjoyable festive season!

Deal Tracker

As you might expect, it’s been a relatively slow week for UK deals.

The Rumor Mill

- Clive Cowdery backs Labour’s growth policies after £8.4 bn sale of his Resolution Life

- Guy Hands’ property company Terra Firma agrees to sell 36,000 military homes to the UK’s Ministry of Defence for almost £6bn.

- Royal Mail takeover by Czech billionaire Daniel Křetínský for £5.3bn is approved by the UK government.

- Goldman Sachs Asset Management agrees on a more than £1.65bn deal to acquire drugmaker Synthon from BC Partners.

- Capri gains 7% in premarket trading shares as it explores the sale of Jimmy Choo and Versace.

- Disruptive Capital and Pension Superfund are in talks over a stake of as much as 40% in De La Rue, UK banknote publisher for £247m.

- Blackstone-owned events organiser Clarion plans acquisition spree

- Iberdrola aims to sell its smart metering business in the UK and looks to raise around £1bn.

- Kosmos Energy walks away from Tullow Oil acquisition.

- Britain’s competition regulator clears Carlsberg’s £3.4 bn acquisition of Britvic.

- Schroders seeks buyers for its Indonesian unit with £3.17 bn in assets.

- Britain’s competition regulator probes BlackRock’s £2.55 bn acquisition of UK data firm Preqin.

- Warburg Agrees to Buy Minority Stake in UK’s United Trust Bank for about £520m.

- FIS is set to acquire UK-based fintech Demica for around £238m.

- Vitesse Energy is to buy Lucero Energy in an all-stock deal valued at £176m.

- Saga PLC agrees to sell its insurance underwriting business to Ageas for £147.6m.

- UK government approves Indian group Bharti’s purchase of 24.5% stake in BT.

- Home improvement retailer Kingfisher is to sell its Romania business to Altex Romania for £58m.

- Paystone is to acquire Ackroo for £16.7m.

- Computershare is to buy London and Poland-based ingage IR.

- IK Partners is to acquire a majority stake in Dains alongside management.

- Spain’s Navantia agrees to buy Harland & Wolff, saving 1,000 UK jobs at H&W’s four shipyards in Northern Ireland, Scotland and England

Salaries and bonuses

- Barclays plans bonus hikes of up to 20% for capital markets bankers, while those in trading jobs are expected to see 5-10% rise.

- UK employers hold pay deals at a 4% median for the fifth consecutive month, with slower growth expected in 2025 due to rising tax burdens.

Job moves

- Alantra has seen 20 managing directors’ departures as it has moved to reorganize its dealmaking unit around key hubs.

- Deutsche Bank has hired Fiona Neville to lead its securities services business in Europe and Nadine Readie to lead the custody and clearing product globally. Neville joins from JPMorgan Chase, while Readie most recently worked for Citi.

- Credit Agricole names Olivier Gavalda as its new CEO.

- North of South Capital gets Dubai approval, London partner to lead new office.

- EY has appointed Martina Keane as its new UK and Ireland financial services leader.

- Deutsche Bank senior private banker Raoul Zehnder exits.

- HSBC has unveiled a fresh line-up of senior leaders in its UK private banking business: Nick Wolf, Rebecca Boardman and Kirsty Moore have been appointed to the leadership team in its UK private banking arm, with Wolf and Moore taking on expanded roles.

- HSBC names John Shipman interim CEO of Swiss private bank.

- Simpson Thacher hires a pair of leveraged finance partners Bryan Robson and William Gwyn from rival US law firm Sidley Austin in London.

- Clifford Chance appoints Odimba-Chapman as London head

Market Trends

M&A Deal Trends Report H1 2024 – Ideals Virtual Data Room

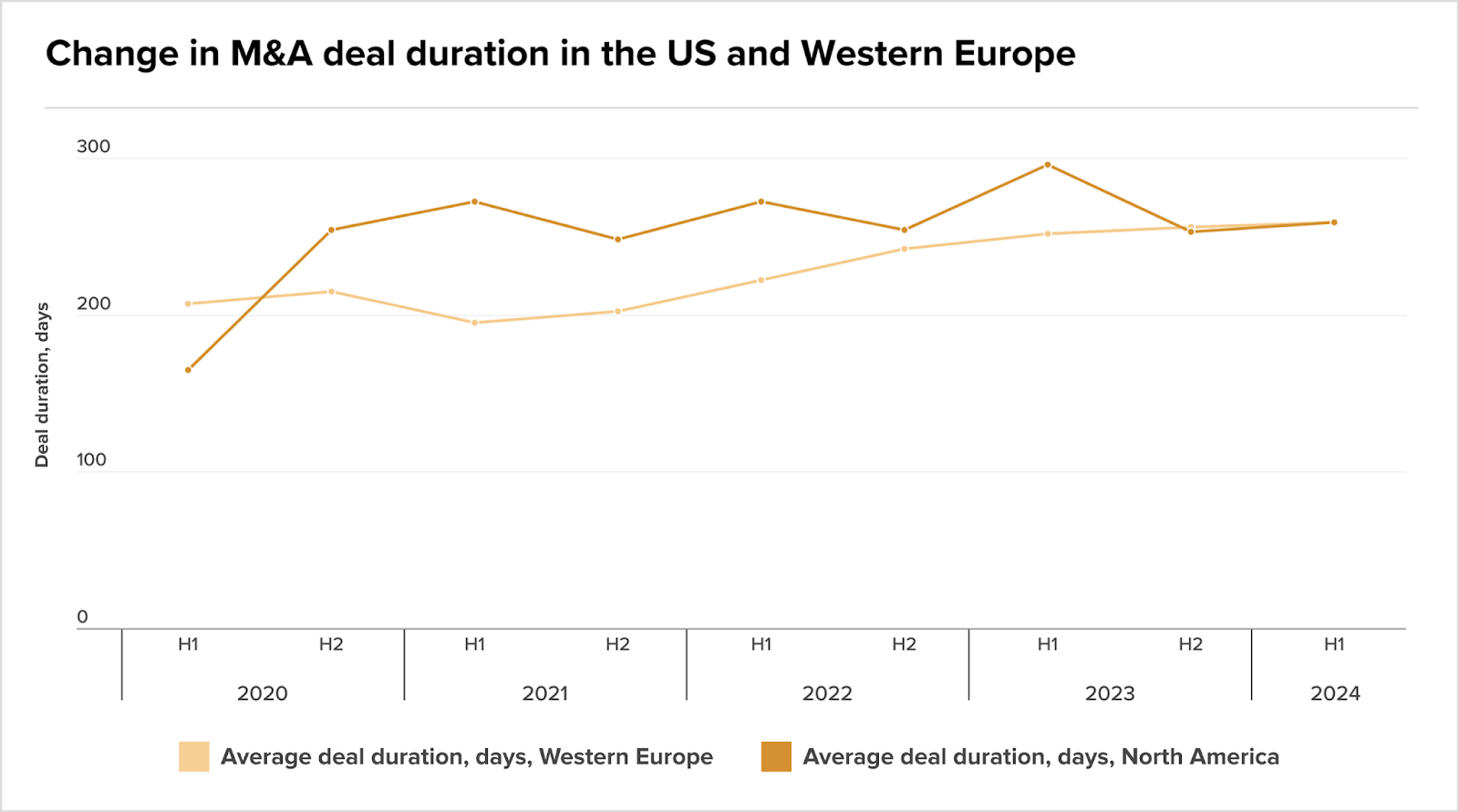

The average time it takes to close an M&A deal increased to 258 days in H1 2024, according to analysis by Ideals VDR. Factors contributing to prolonged timelines include rising interest rates, heightened focus on ESG, regulatory hurdles and more rigorous due diligence driven by technological advancements.

It also found that 52% of deals in H1 2024 exceeded six months to close, however timelines are gradually improving, with a 7% reduction from H1 2023.

A bumper year ahead?

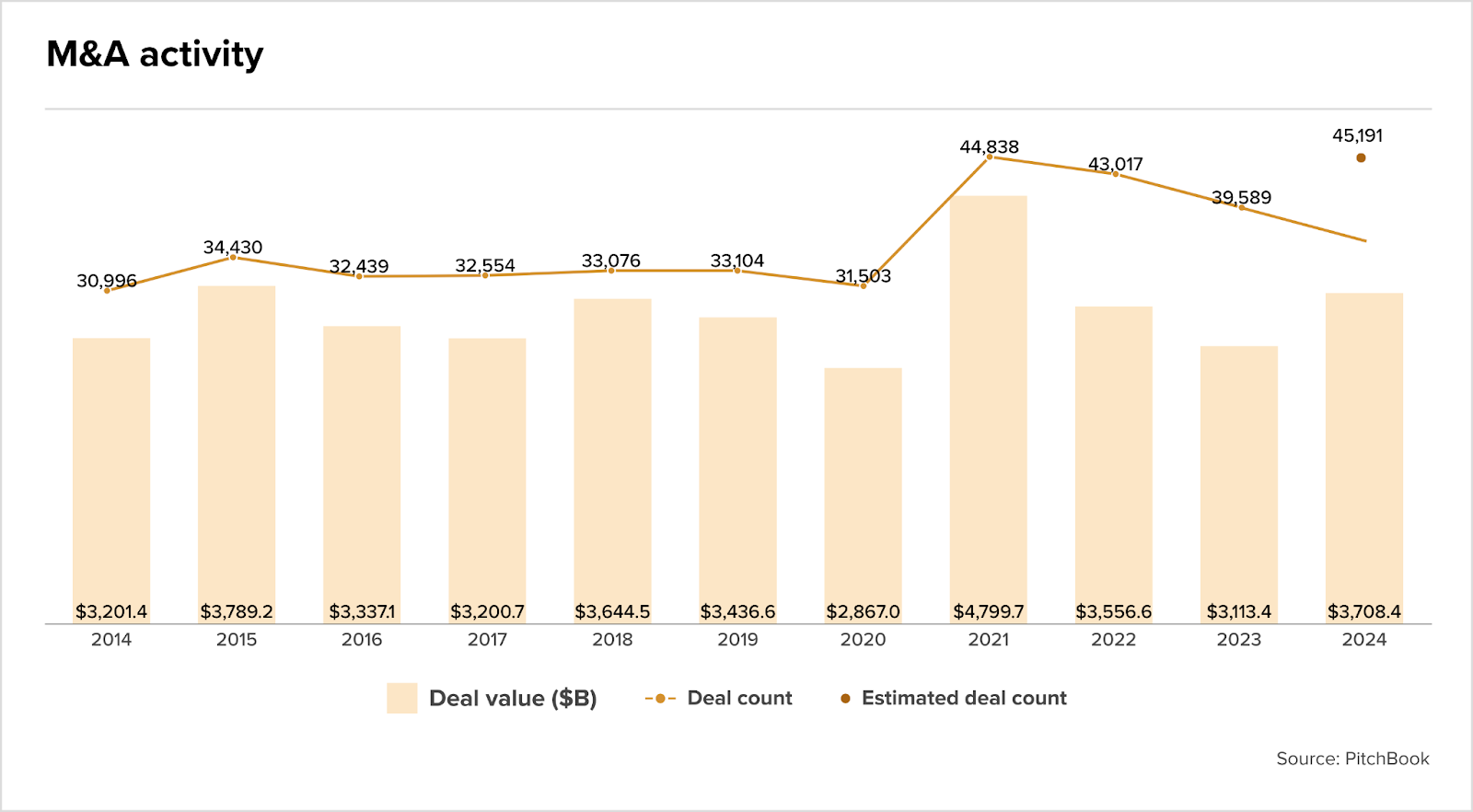

M&A advisors are significantly more optimistic about the UK’s short-term economic outlook, according to a new study by CIL Management Consultants. Confidence is surging, with 48% of UK dealmakers now positive, a significant increase from just 19% at the start of the year. This shift comes after a turbulent 2023, when only 15% of dealmakers reported high or average deal activity, and 48% held a negative view on the economy.

The latest findings indicate a recovery in M&A activity, with 28% of correspondents seeing better deal flow and 24% noting improved asset quality. Looking ahead, 76% of dealmakers now expect an increase in M&A activity in 2025.

Six M&A predictions for 2025 from Brabners

T’is the season for 2025 predictions, with Independent law firm Brabners getting in early with six M&A trends for 2025.

Key predictions include:

- Profitability challenges may impact business valuations, particularly as new tax policies from the Autumn Budget are implemented.

- International activity is expected to remain strong as foreign buyers are drawn to the UK’s recovering economy and clearer environment post-Brexit.

- Interest rate changes are likely to increase M&A appetite, especially as base rates continue to decrease.

- Net zero target will spur investment in acquisitions that help companies enhance sustainability efforts and meet regulatory goals.

- Capital Gains Tax (CGT) changes are expected to have limited impact on the M&A market, with stability in tax rates easing concerns.

- Business Asset Disposal Relief (BADR) changes are predicted to lead a rush of activity in the run up to April 2025, as SME shareholders look to take advantage of current rates before the increase.

End of 2024: Uncertainties, Inflation, Exits

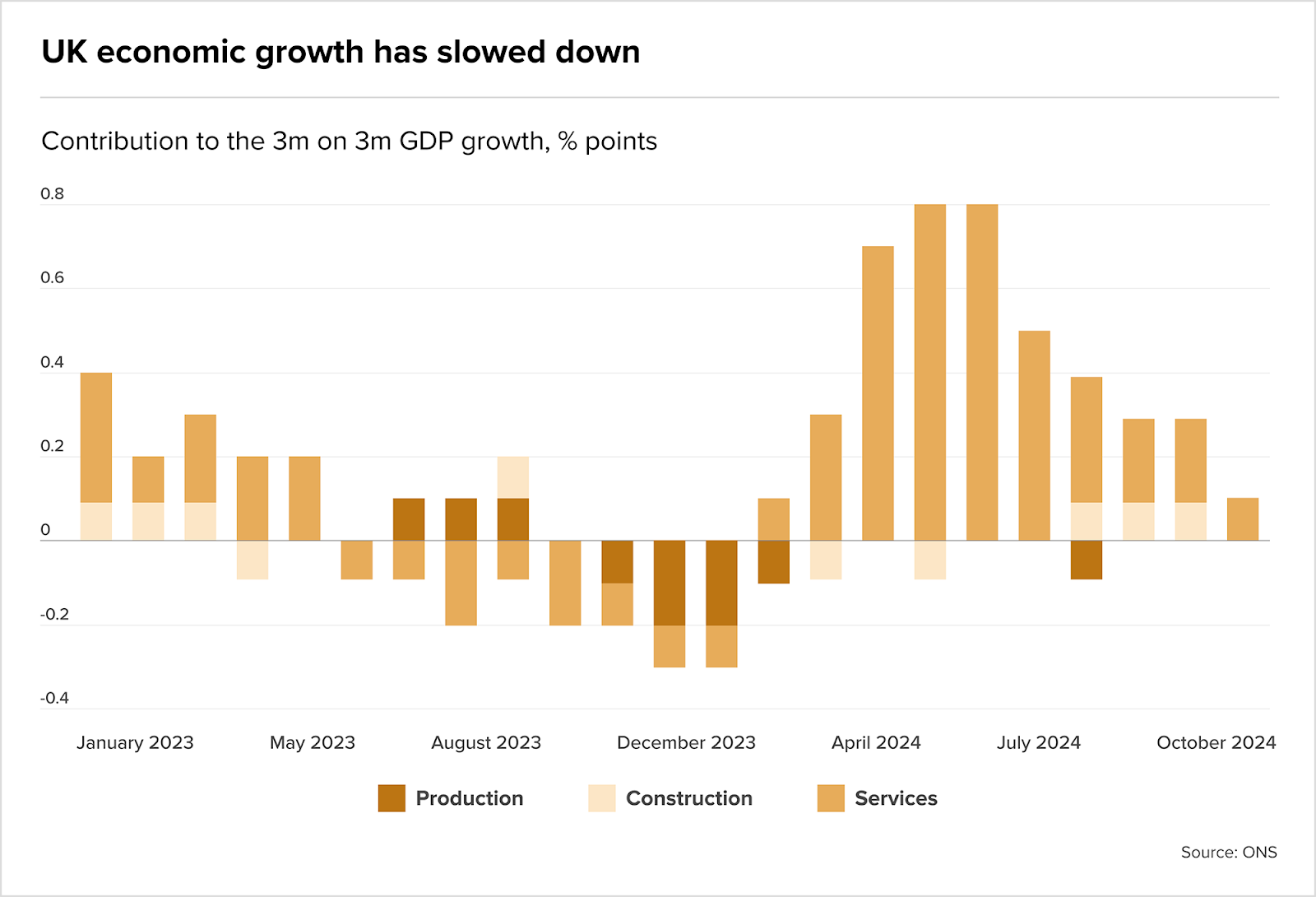

The UK economy unexpectedly shrunk by 0.1% in October 2024, marking the second consecutive monthly decline. It reflects ongoing pressures from high borrowing costs, low business confidence and increased tax burdens, presenting challenges for Labour’s growth-focused economic agenda.

Bank of England’s decision on interest rates as UK inflation hits 8-month high

UK inflation reached an eight-month high of 2.6% in November, rising from 2.3% in October, amid steady underlying pressures such as services inflation at 5.0%. It caused the Bank of England to hold interest rates at 4.75% during its final Monetary Policy Committee meeting of 2024, with traders looking for signals on 2025 rate cuts.

Governor Andrew Bailey recently indicated that BoE might pursue four rate cuts next year, though he cautioned against rapid reduction. Both Reuters and Morningstar report that market expectations for cuts in 2025 remain strong, reflecting broader uncertainty in the UK’s economic climate.

This is also mirrored in the London Stock Exchange, which is experiencing its largest exodus of companies since the financial crisis. A total of 88 businesses have left the main market this year, including major FTSE 100 firms like Ashtead and Flutter, and only 18 new listings took their place – the fewest in 15 years. Despite governmental and regulatory reforms, the allure of New York continues to draw high-value businesses, raising concerns about the City’s competitiveness.

AI fuels Technology M&A in 2025

The increasing availability of AI, along with the ongoing development of AI-driven processes and generative AI, has positioned software as the primary driver of technology M&A, with transactions exceeding £55bn in H1 2024.

However, separate analysis shows that while the UK tech M&A market saw 955 deals worth £14bn in 2023, over £9bn of transactions have been underperforming. Private equity, which was involved in 64% of UK tech deals, has faced challenges, with many deals not delivering the anticipated value. Nonetheless, the outlook for 2025 remains positive, driven by private equity’s record capital reserves, improving business confidence and digital transformation.

Fundraising

- Activist Investor Bluebell Capital closes its five-year-old activist hedge fund after struggling to raise funds from investors despite targeting big European companies in a series of high-profile campaigns.

- Access Group secures £900m add-on loan and PIK financing, increasing its debt package to £5.65bn to support buy-and-build.

- Journey Hospitality secures new multi-million-pound funding from Growth Lending.

Daniel Black

Daniel Black