Hello,

Business is slowly picking up after the summer lull, with a number of intriguing deals in our Rumour Mill. The UK government has also brought us a steady stream of scandals and missteps, with Peter Mandelson the latest high-profile name to be forced to leave their post this week. Never a dull moment.

In the week’s major M&A stories:

- DoorDash’s takeover of Deliveroo got EU approval

- TDR sold David Lloyd gym chain to itself

- Starling Bank aiming for a £4bn valuation in share sale

Thanks for reading, and connect with me on LinkedIn if you want to discuss how I can help with your next M&A deal.

Share your thoughts on AI for a chance to win $100

How are you currently using AI during M&A deals? We’re surveying top dealmakers on how they use AI as part of a major research project.

Please complete this short survey and you’ll be entered into a prize draw to win one of three $100 Amazon vouchers.

Deal Tracker

Our weekly roundup of publicly confirmed M&A deals in the UK.

The rumour mill

- Why a bank might be the perfect buyer for Evelyn

- Anglo American and Teck Resources to create $50bn mining giant

- BHP seen as unlikely to pounce on Anglo or Teck as it eyes organic growth

- Starling Bank targets £4bn valuation in secondary share sale

- Balderton Capital sells about $1bn worth of Revolut shares

- RBC makes fresh European push to hit top 10 target

- CVC sees growing appetite for European PE

- Permira and Blackstone bet on Dubai real estate with Property Finder deal

- Permira seeks $4bn for sale of contract drugmaker Cambrex

- Permira to take minority stake in RightShip

- European Union approves DoorDash’s purchase of Deliveroo

- KKR joins PRS REIT sale process

- TDR Capital to buy majority stake in David Lloyd via continuation vehicle.

- Cinven to invest in audit and advisory firm Grant Thornton Germany

- Samsung Life to buy minority stake in Hayfin Capital Management

- Alchemy agrees sale of Apollo Group Holdings Limited to NASDAQ-listed Skyward Specialty

- Thames Water creditors table revised £20.5bn rescue plan

- Kent and Greenwich universities to merge in bid to strengthen financial footing

Industry news

- Rachel Reeves says economy not broken, it’s stuck; eyes tax reform to help small business expansion

- Starmer tightens grip on UK economic policy with powerful ‘Budget board’

- Barclays boss Venkatakrishnan urges against UK bank tax

- John Lewis losses widen to £88m despite increased sales

- Merck scraps £1bn London HQ with attack on government support

- UK’s legal services exports have risen by 44% in four years

- New British trade minister heads to China for first talks since 2018

- Britain’s Octopus Energy partners with Chinese wind turbine maker

- HSBC AM Launches PE Vehicle for HNW Investors

Salaries and bonuses

- 35-year-old London hedge fund prodigy paying $140k in support staff hiring spree

- Some credit research analysts are earning $440k+ in London

- London hedge fund paying £248k kept hiring as revenues fell

- Jefferies’ top bankers earn $2m in London, but a handful of top traders at Nomura don’t do badly

- Goldman Sachs, JPMorgan, Morgan Stanley, Citi and BofA: top salaries & bonuses in London

- Hedge Fund Point72 paid 300+ staff £650k on average in London

Job moves

- Apollo’s European lead partner Michele Raba to depart after 15 years

- Cboe taps Goldman Sachs for European equity sales director

- RBC poaches Citigroup commodities salesman Ruffini in Europe push

- Standard Chartered taps HSBC banker Welch to lead M&A in London

- Barclays taps McKinsey partner to lead mass affluent business

- DRW taps banks and hedge funds for two dozen London traders

- Jefferies taps Tikehau deputy CEO to lead private credit strategy in London

- AlbaCore builds infra debt platform with UBS AM team hire

Market trends

TIC is the gift that keeps giving

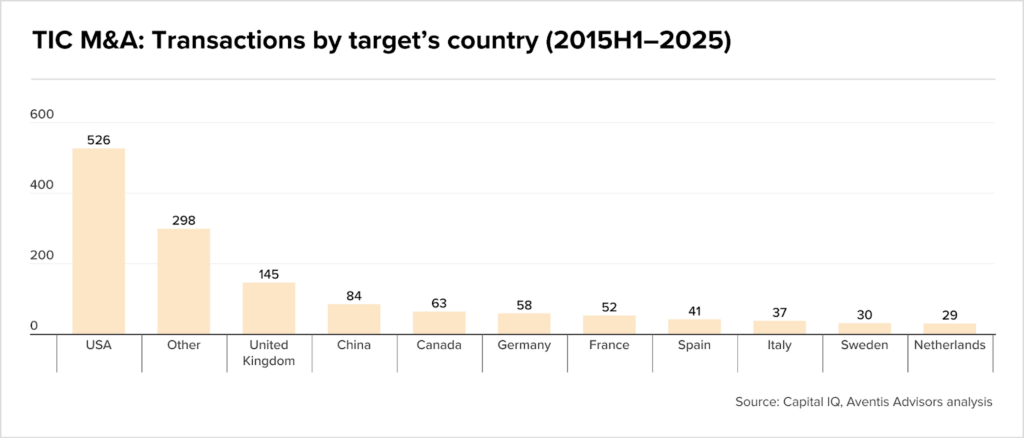

Aventis Advisors has reported a healthy landscape in the Testing, Inspection, and Certification (TIC) sector, with over 1,300 transactions recorded globally in the last 10 years. In the times when AI governance, supply chain resilience and ESG compliance dominate boardroom agendas, TIC companies have become the invisible infrastructure keeping global commerce moving, validating everything from semiconductors chips to carbon credits.

Analysis shows the annual deal count has hovered between 110 and 150 in the past decade. The UK captured 145 deals during this period, which ultimately makes it the second largest TIC M&A hub worldwide, trailing only the US with its 526 transactions.

What is more, PE loves TIC and it’s for good reason: financial buyers represented 36% of deals in H1 2025, up from just 22% in 2015. The authors state that the sector offers predictable recurring revenues from contact-based testing work, asset-light models with attractive cash conversion, and mission-critical services that embed companies in customer supply chains.

Powering through red tape

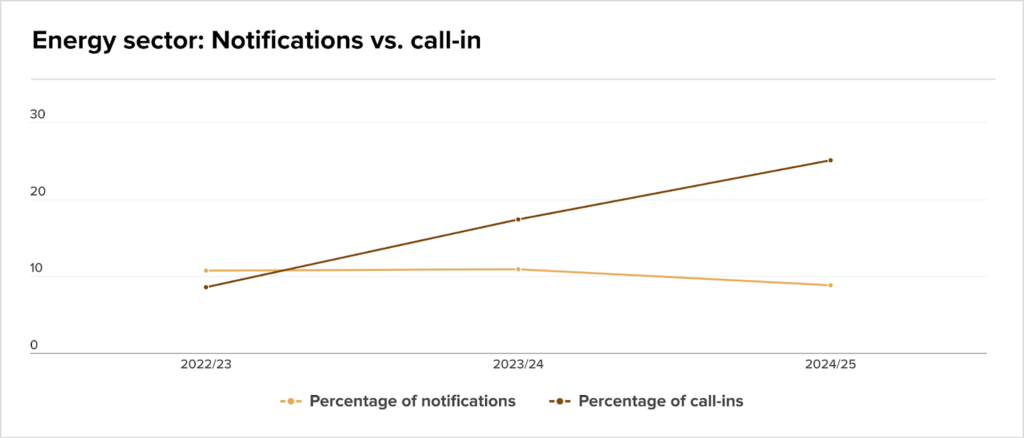

UK energy deals are increasingly navigating the National Security and Investment Act’s (NSIA) complex web, with the sector accounting for 25% of all government call-in notices in 2024/25 despite representing just 10% of total notifications.

According to White & Case, Ed Miliband’s pledge to make Britain “the most attractive place for private capital to invest in clean energy” faces the reality that even modest acquisitions now trigger mandatory reviews.

Fewer lots, but each commanding premium prices

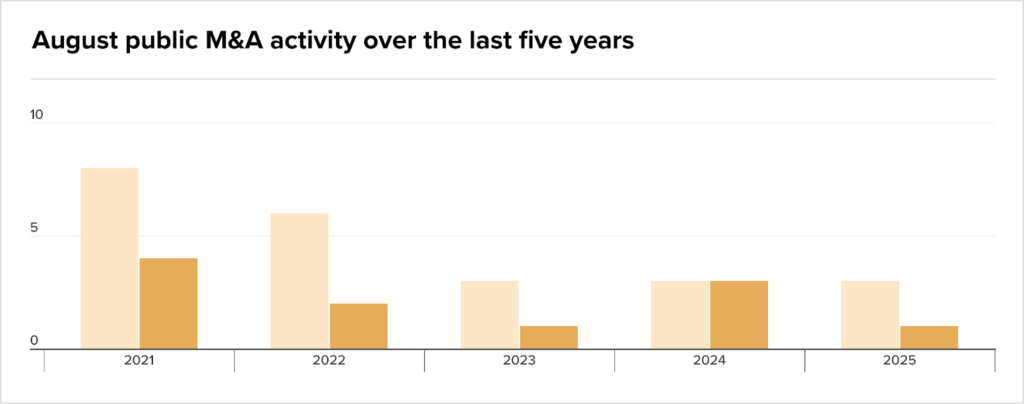

The M&A data from late summer is in and it seems like dealmakers in the UK were enjoying time off. August was the quietest month of 2025 with just three firm offers, but this is in keeping with summer deal volumes in 2024 and 2023.

However, the competitive dynamics that have characterised 2025 continued even in August’s subdued environment. This time it involves the Warehouse REIT takeover battle between Blackstone and Tritax Big Box. When neither declared their offers final by the required deadline, the Takeover Panel announced an auction. Yet Tritax withdrew from increasing its offer before the auction commenced, leading to the procedure’s cancellation.

Chart shows firm vs. possible offers

Did you know Ireland is thought to mean “fertile soil”?

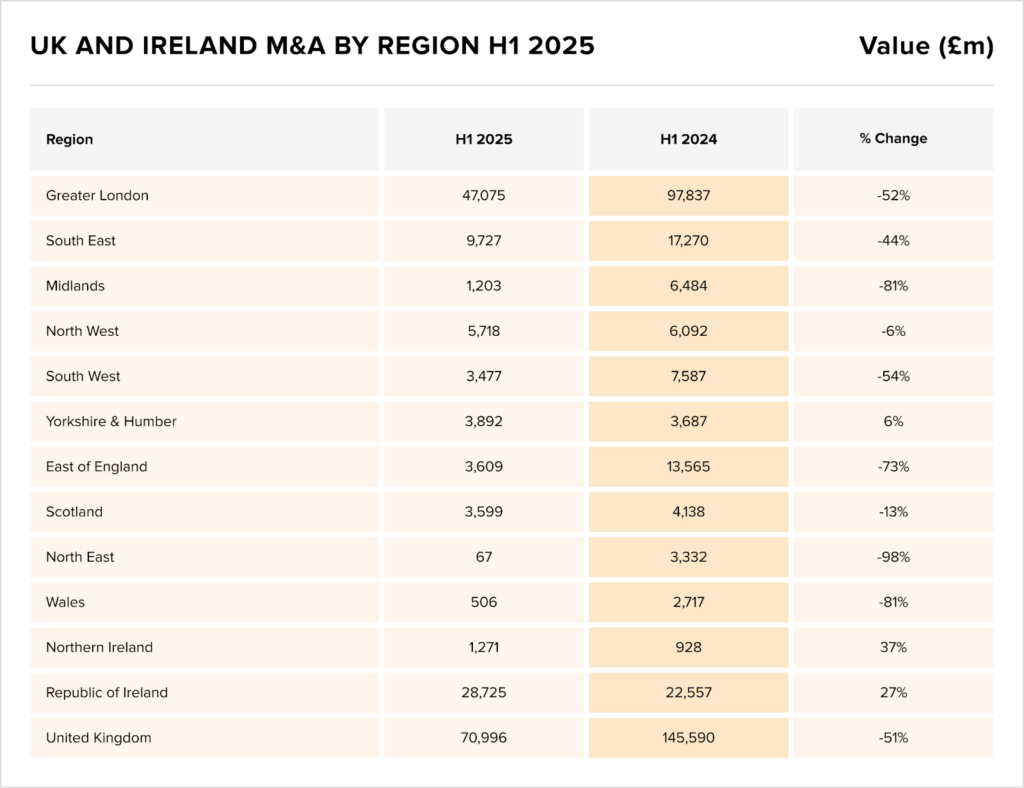

And lastly, the breakdown of UK and Ireland M&A activity in the first half of 2025, conducted by Experian, provides a clear view of regional deal volumes and values. It shows that while overall activity in H1 was down 16% compared to 2024 – with 3,003 deals compared to 3,589 – the value of those deals halved from £146bn to £71bn.

On a regional level, only Northern Ireland and the Republic of Ireland bucked the trend for falling deal values, with increases of 37% and 27% respectively.

Daniel Black

Daniel Black